Binance Bots Now Included!

It is now possible to automate your trading using the indicators and Binance. I used Binance API to code a bot system, so that this website can now receive TradingView signals and directly place orders on your Binance account. We will see what is required, and how it works.

What you need to automate your trading

To create trading bots, you will need 2 things: a Cyatophilum Indicators subscription, and a Binance account. The subscription includes access to a package of TradingView indicators, from which you can create strategies and alerts. Once your have that, you can start using the Binance Bots page.

Binance is a cryptocurrency exchange, one of the most used and trusted in the world, for its relatively low fees and large amount of markets. You can create an account here if you haven't one yet.

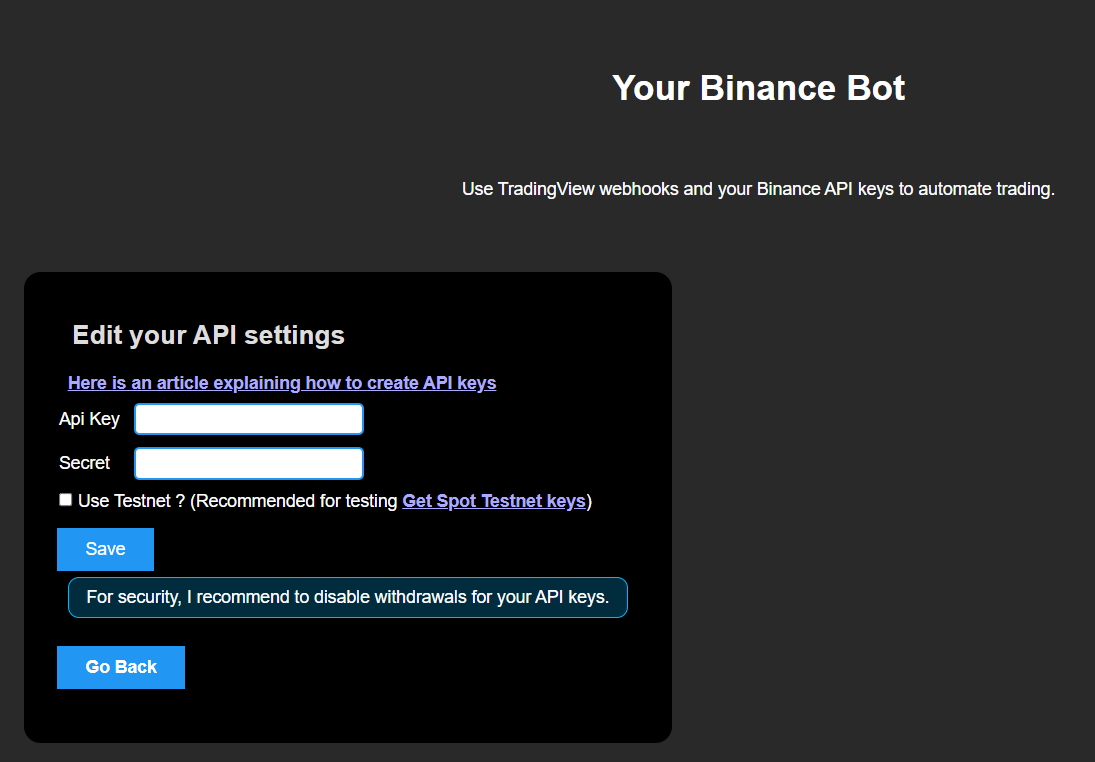

Setup your Binance connexion

Once you get the hand of it, you can create a bot in a few seconds. But first, you need to setup your Binance connexion. In Binance, you have to retrieve your API keys: the client, and secret. Here is a detailed article about it.

About API keys: API keys are used to place orders by the bot and read trade history. When you save your settings, your secret key is encrypted before being saved in the database, meaning I, the owner of the database, or a even hacker, could not use them to place orders.

There is the option to use Testnet, which is recommended if you are getting started and want to test the bots without using founds. Testnet is a separate network dedicated for testing only. Follow this guide to get Testnet keys.

Create a bot

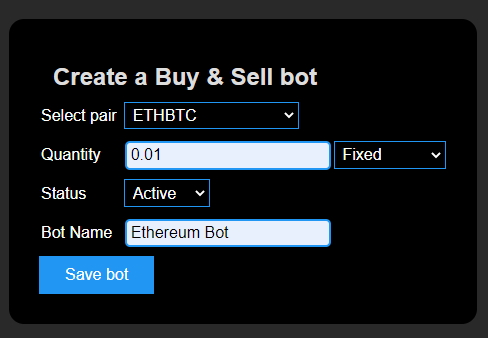

Once your API settings are set, you can create as many bots as you want, by clicking "create bot".

Select the pair you want to trade, the quantity to buy/sell on each order, and give the bot a name. Note that for now, it is only possible to trade SPOT market and limit orders with a fixed or % equity quantity. Regarding the quantity, there is a minimum value for a trade to execute, which is around 10 $. The quantity unit corresponds to the base currency. For example with BTC/USDT, the base is BTC so your quantity is the amount of BTC to buy/sell on each order.

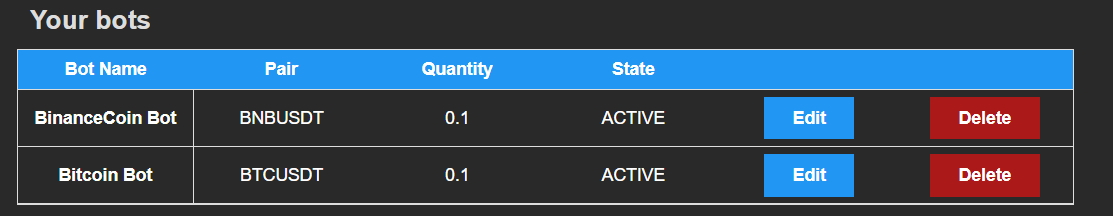

Once your created your bot(s), they will appear in a list below.

Link a strategy to a bot

The final step is to link one of the indicators to your bot. For this example, I used Cyatophilum Swing Trader, with the Adaptive Channels strategy on the BTCUSDT 4 hours chart.

If you are already subscribed, you can copy paste the chart directly into your own TradingView: https://www.tradingview.com/chart/JfAYFLlg/.

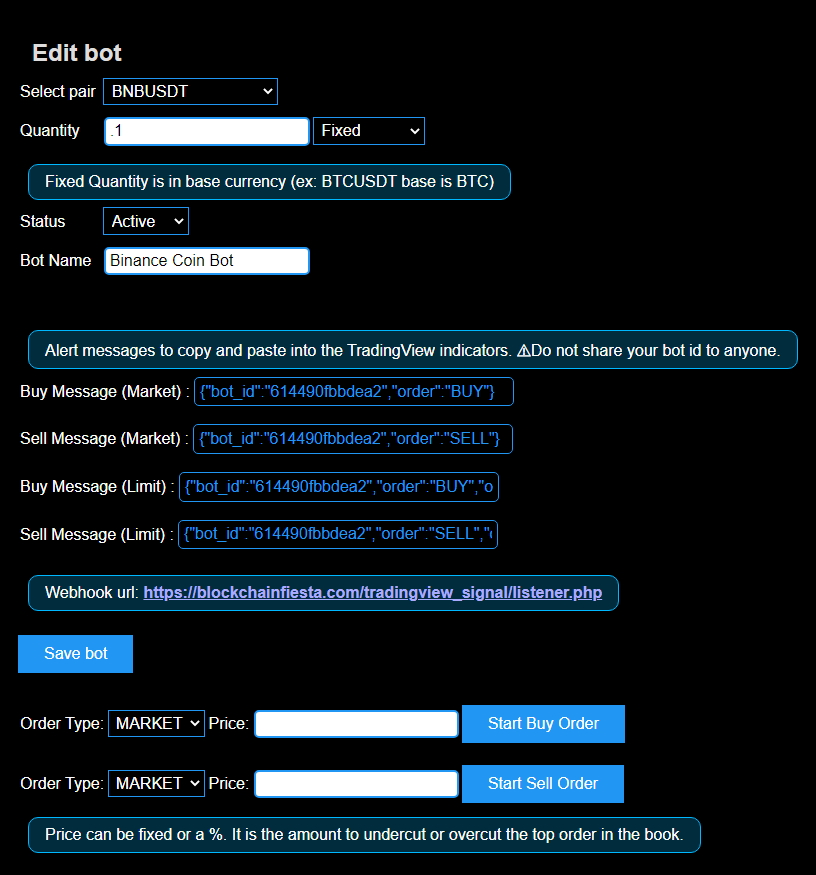

Now that your strategy is ready, you can go back to the Binance Bots page. Click Edit bot and you will arrive on a page with more bot details.

What interests us is the Buy Message and the Sell Message, as well as the Webhook url. First, copy the Buy Message. Go back to your strategy and open the indicator settings.

You can add the "qty" parameter in the bot message to make it buy/sell a different quantity from the default one set in the bot.

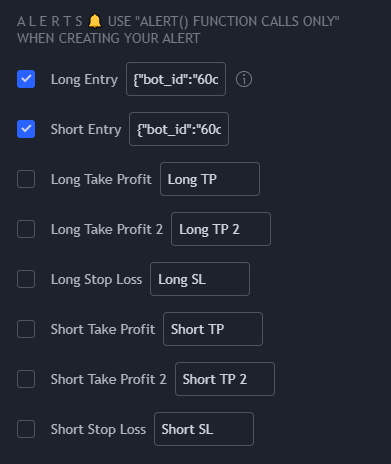

Scroll down to the alerts section. We only need the Long and Short entry for our strategy, so you can disable the other alert events. Paste the Buy Message in the "Long entry" text input, and do the same with the Sell Message in the "Short entry" input.

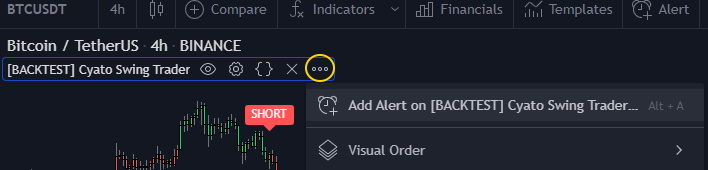

Once you have done that, I recommend to save your chart. All that is left to do is create the alert. For that, click "Add alert .."

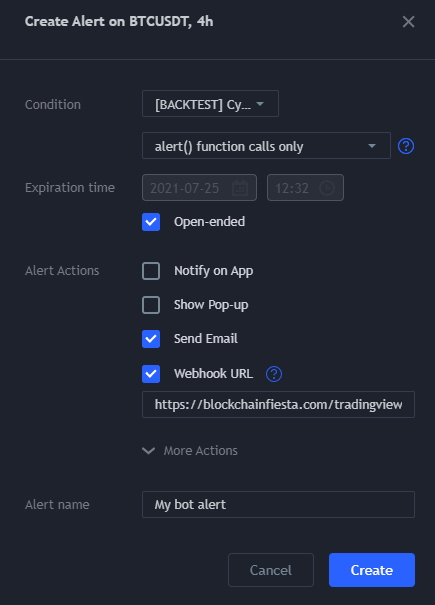

A pop-up window will appear. Make sure that the indicator is selected in the condition field. Select "alert() function calls only". Then, copy-paste the webhook url which is : https://blockchainfiesta.com/tradingview_signal/listener.php

Finally, change the alert name so you can recognize it and click "Create". More detailed info on alerts in this article.

That is all! Your bot is now receiving alerts and placing orders automatically.

Check how your bot is going

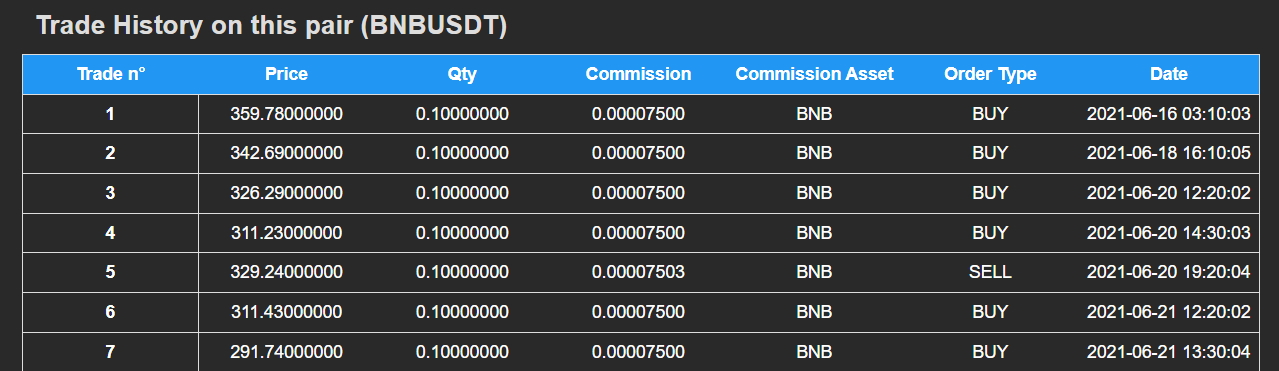

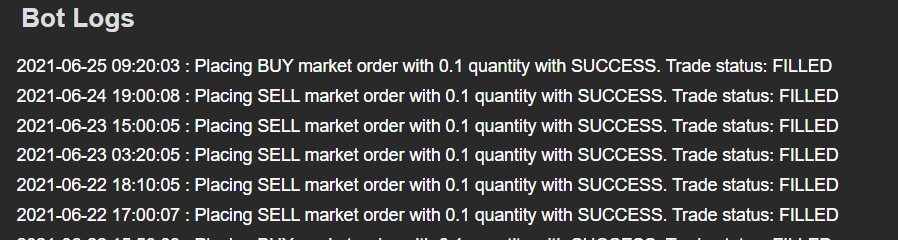

Once your receive your first alert, you can verify that the order has been filled in your Binance bot page. In the list of bots, click Edit bot once again, or refresh your bot page. Below the bot settings, you will see the Trade History.

Below the Trade History, you will find the bot logs. This is useful to check for errors if any.

I will keep this article updated as I plan to add more features to the bots. Make sure you are in the newsletter if you want to receive the latest updates (once every 1-2 months). Thanks for reading, and see you in the comments if you have any question.

Written by Cyatophilum - Created 2 years ago - Last edited today

Recent Articles

Game Theory Optimal (GTO) strategies are commonly used in competitive games like poker, where the objective is to make decisions that are unexploitable by opponents. Applying GTO principles to trading involves creating strategies that minimize losses and maximize gains, regardless of market conditions or the actions of other market participants.

Optimal Play

Just like in poker, trading ...

I'm thrilled to announce the release of my latest tool – the Bitcoin Trend Indicator (BTI), and it's available for free on TradingView!Based on CoinDesk's research, the BTI is designed to help you easily identify and analyze Bitcoin trends. With multiple exponential weighted moving averages analysis and clear trend signals, it's a powerful addition to your trading toolkit.Ready to give it a try? ...

Hi Traders, in this short tutorial we will see how to autotrade on Binance.

Requirements

- A TradingView account with Webhooks notifications.

TradingView allows you to backtest your strategy and create alerts. For now, our bot page only works with TradingView alerts Webhook notifications.

Important: the Essential TradingView plan is required to unlock this feature. Without Webhooks, ...

As of May 23, 2024, Bitcoin (BTC/USDT) is experiencing some notable movements on the daily chart. Here's an in-depth technical analysis to provide insights into the current market conditions and potential future price actions.

Price Action and Key Levels

Current Price: $69,265.99 (down by 1.26% today)

Resistance Levels:

...

how can use the take profit

When you created a bot, click edit bot. Then, you can set a take profit and save your bot.