244 bots created

Crypto Trading Bots

Automate your cryptocurrency trades with our

trading bots to optimize your trading simply and

smoothly.

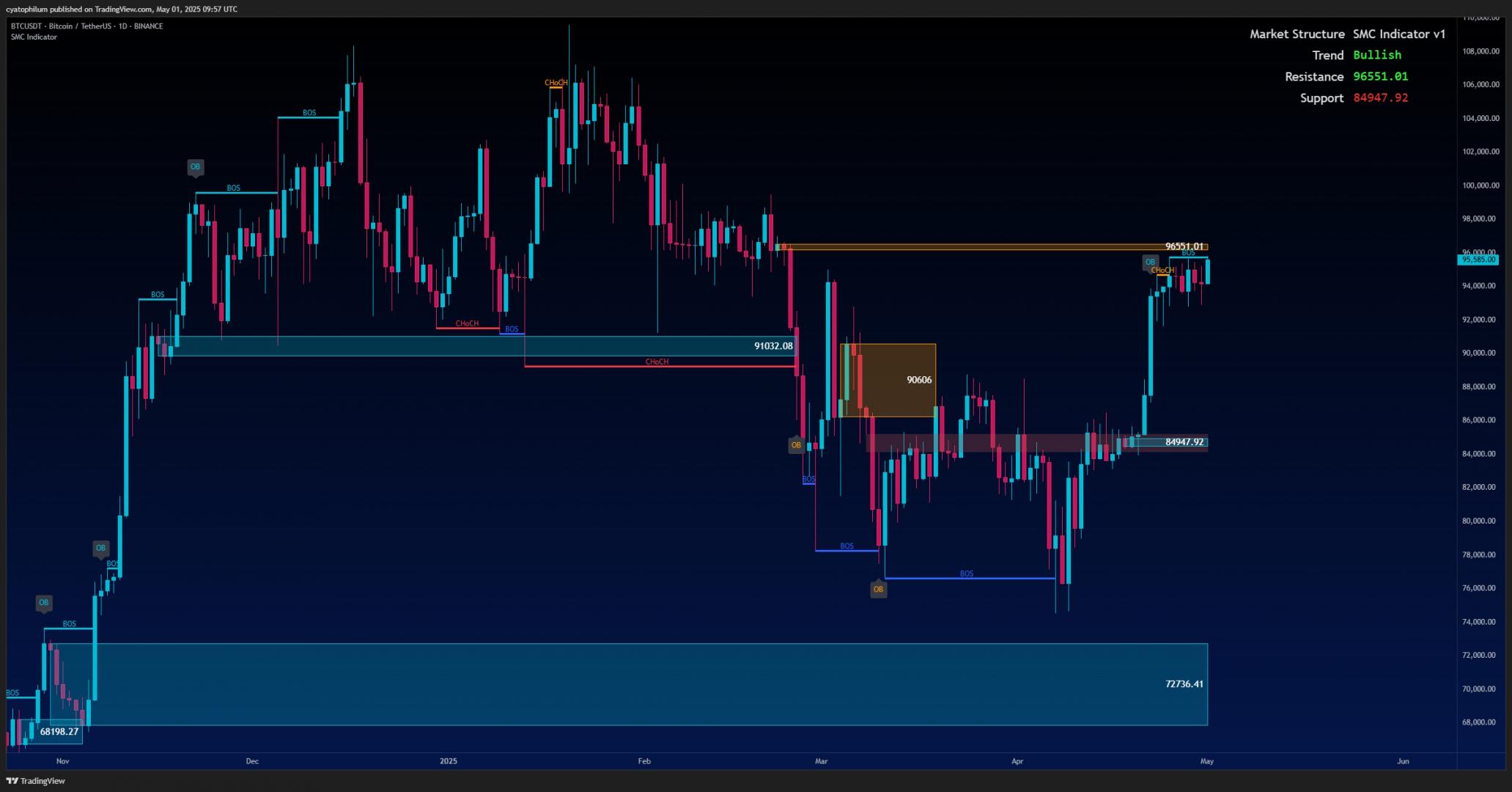

TradingView Indicators and Binance API

Improve your trading strategies with our custom

indicators for TradingView and easily integrate them

with Binance using the API for an optimized trading

experience.