A Swing trade engine

This Swing Trading Indicator allows you to build your own strategies, backtest and alerts.

How does it work ?

Pick your indicator

The particularity of this indicator is that it contains several indicators, including custom ones, that you can choose in a drop down list.

· CYATO AI: A custom indicator that will catch important reversal points.

· ADAPTIVE CHANNELS: A custom indicator inspired by Donchian Channels which bands will adapt to the volatility.

· SARMA: A combination of Parabolic Stop and Reverse and EMAs (20 and 40).

· SAR: Regular Parabolic Stop and Reverse.

· SUPERTREND: A reversal indicator based on Average True Range.

· QQE: An indicator based on Quantitative Qualitative Estimation.

· CHANNELS: The classic Donchian Channels.

· DOUBLE CHANNELS LONG: A double Donchian Channels strategy for longs only.

· DOUBLE CHANNELS SHORT: A double Donchian Channels strategy for shorts only.

· ICHIMOKU: The Ichimoku Kumo Cloud strategy.

· HEIKIN ASHI: A custom strategy based on Heikin Ashi candles.

Trendlines

You can pick between a list of built in trendlines to build a crossover or slope change strategy. The trendline can also be used to filter off trades from a base indicator above.

Stop Loss System

Stay safe. Configure your stop loss in TradingView! The integrated Stop Loss system will trigger an alert to exit the trade. You can secure your profits with the trailing system!

Take Profit System

Secure your gains. The integrated Take Profit system will trigger an alert to exit the trade. Use the Trailing Take Profit feature to make even more profits!

How to use this indicator ?

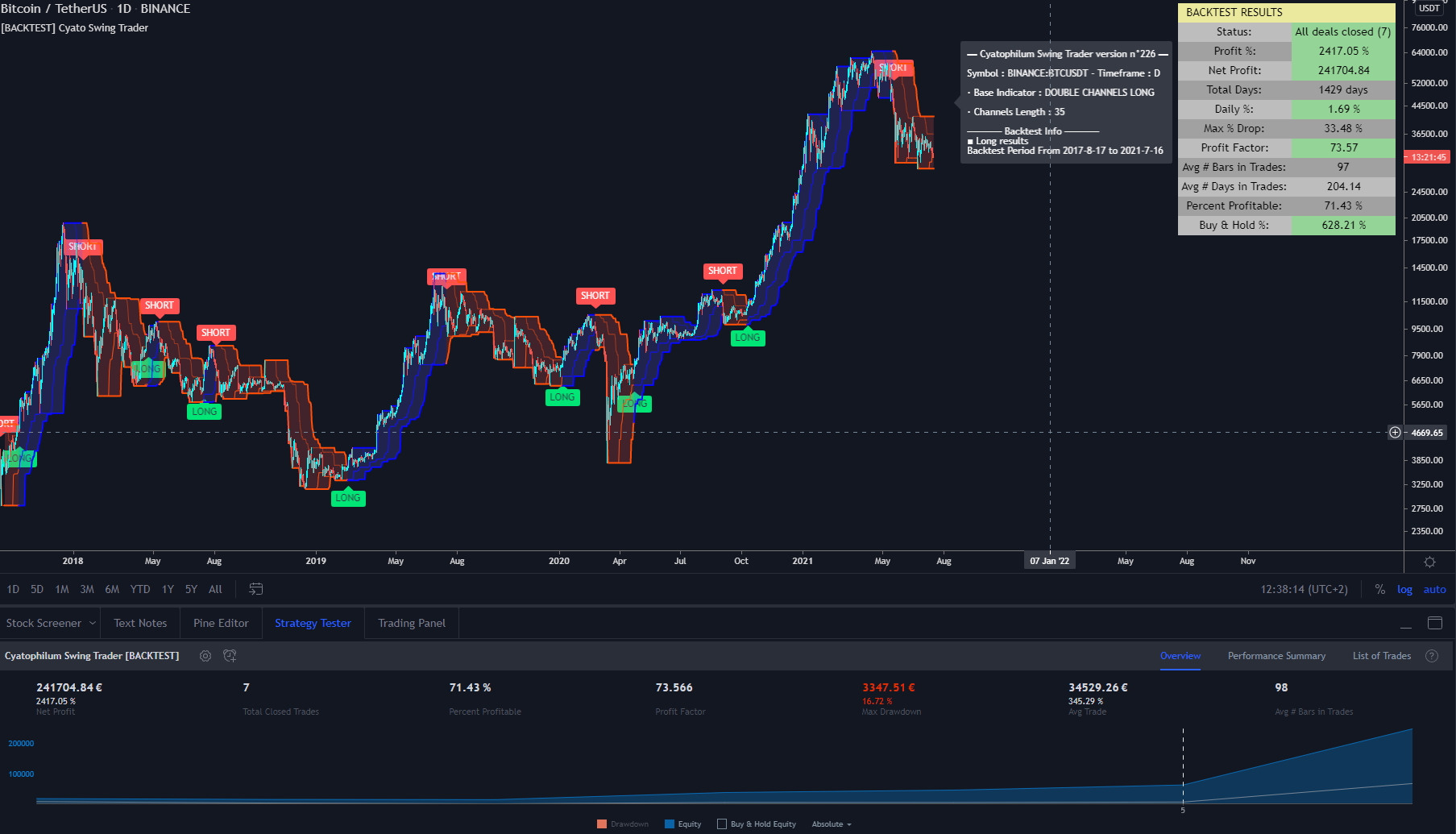

How to Backtest

You can backtest using the Strategy Tester which will give you a quick overview of the strategy results over the given period of time.

There is also a backtest panel built in the indicator that gives more detailed information such as the daily % or the Buy & Hold comparator.

Automated Alerts

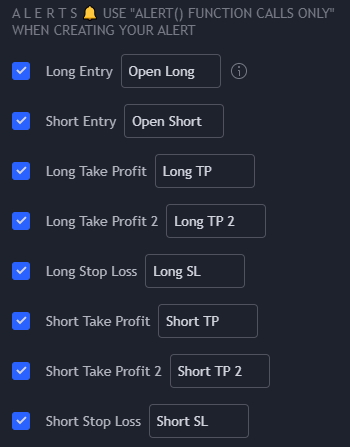

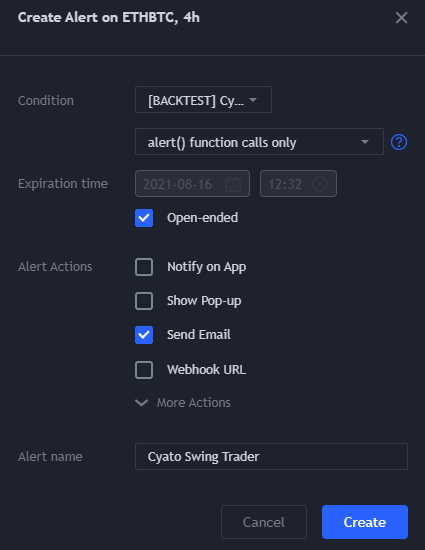

The indicator is using the newest alert system:

1. Write your alert messages in the indicator settings (alert section at the bottom)

2. Click "Create Alert" as usual, but choose "alert() function calls only"

3. Give you alert a name

Pre-configured charts, ready to use

If you do not feel like creating your own strategy, you can pick up one of the many already created by the community.

These charts are available on my Discord Channel

Advanced User Guide

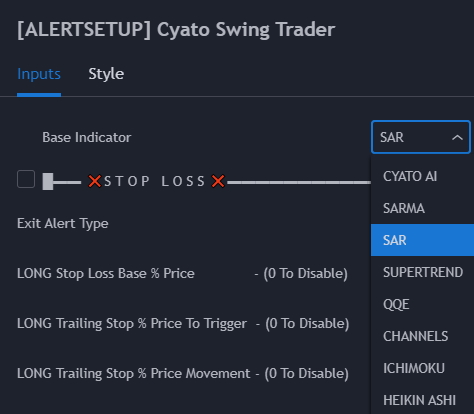

Base indicator

Choose between several technical indicators for your base entry condition.

| Parameter | Description |

|---|---|

| Base Indicator | Build your entry from Swing trading indicators. |

Stop Loss

Add a stop loss to the strategy. You can also make it trail.

| Parameter | Description |

|---|---|

| Exit alert type | If you use Once Per Bar Close, the strategy will ignore candle wicks, and only consider a stop loss at bar close. Using Once Per Bar, the strategy will take inside bar movement into account. You must use the same type of alert when creating a stop loss or exit alert. |

| Stop Loss Base % Price | Starting Value for LONG/SHORT stop loss. |

| Trailing Stop % Price to Trigger | First parameter related to the trailing stop loss. Percentage of price movement in the right direction required to make the stop loss line move. |

| Trailing Stop % Price Movement | Second parameter related to the trailing stop loss. Percentage for the stop loss trailing movement. |

| Reverse order on Stop Loss | Use this if you want the strategy to trigger a reverse order when a stop loss is hit. |

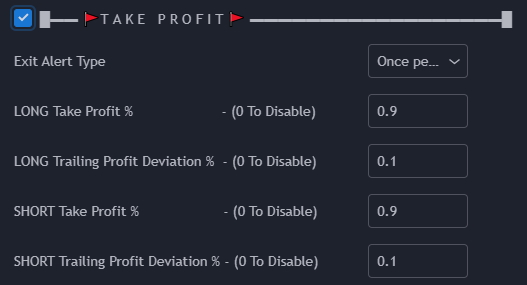

Take Profit

Add a take profit to the strategy. You can also make it trail.

| Parameter | Description |

|---|---|

| Exit alert type | If you use Once Per Bar Close, the strategy will ignore candle wicks, and only consider a take profit at bar close. Using Once Per Bar, the strategy will take inside bar movement into account. You must use the same type of alert when creating a take profit or exit alert. |

| Take Profit % | Take profit value in percentage of price. |

| Trailing Profit Deviation % | Percent deviation for the trailing take profit. |

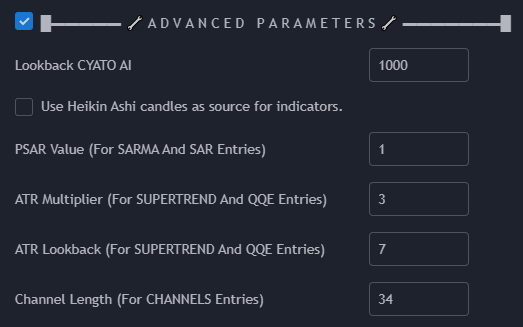

Advanced Parameters

A little fine-tuning.

| Parameter | Description |

|---|---|

| Lookback CYATO AI | Length in bars used to calculate the bands. |

| Use Heikin Ashi candles as source for indicators. | Turn it ON to inject Heikin Ashi candle Open/High/Low/Close data into the base indicators. We use this instead of the Heikin Ashi chart because backtesting is not accurate on these charts, and we want real price values for the Stop Loss/Take Profit system |

| PSAR Value | Used with the SARMA and SAR indicators. Increasing it will get you more entries, while reducing it will strengthen the entries. |

| SuperTrend ATR Multiplier | Used with the SuperTrend. Changes the ATR Multiplier. |

| SuperTrend ATR Lookback | Used with the SuperTrend. Changes the ATR Lookback. |

| Channel Length | Used with the Channels indicator. Changes the Donchian Channel Length. |

Private Discord Server: https://discord.gg/RVwBkpnQzm