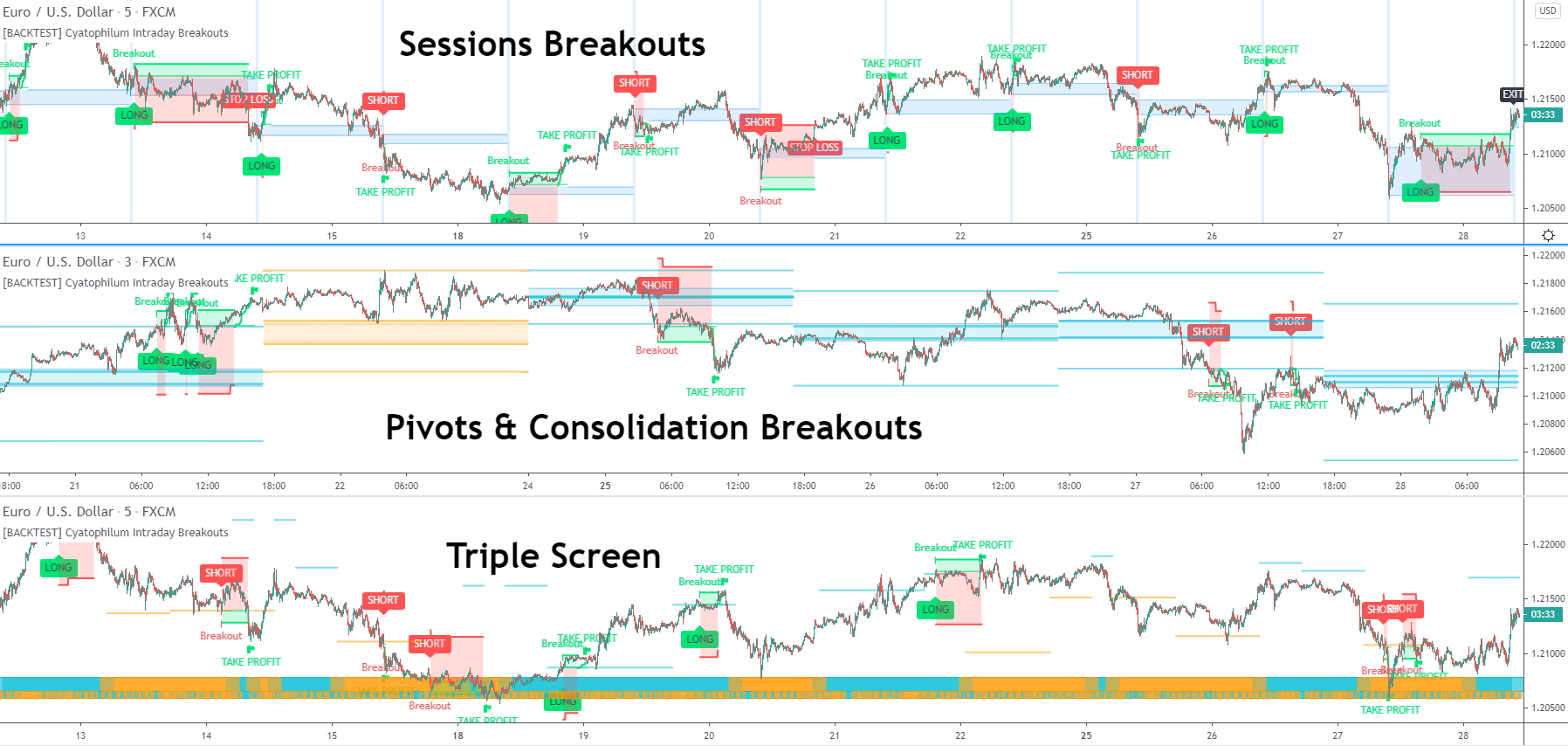

Trade breakouts in intraday using 3 different strategies.

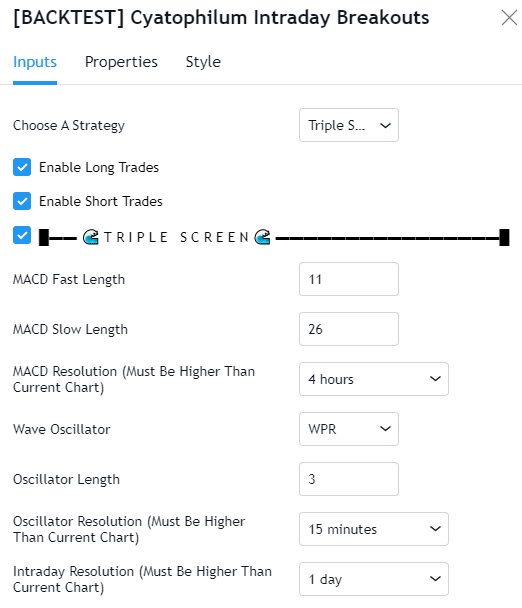

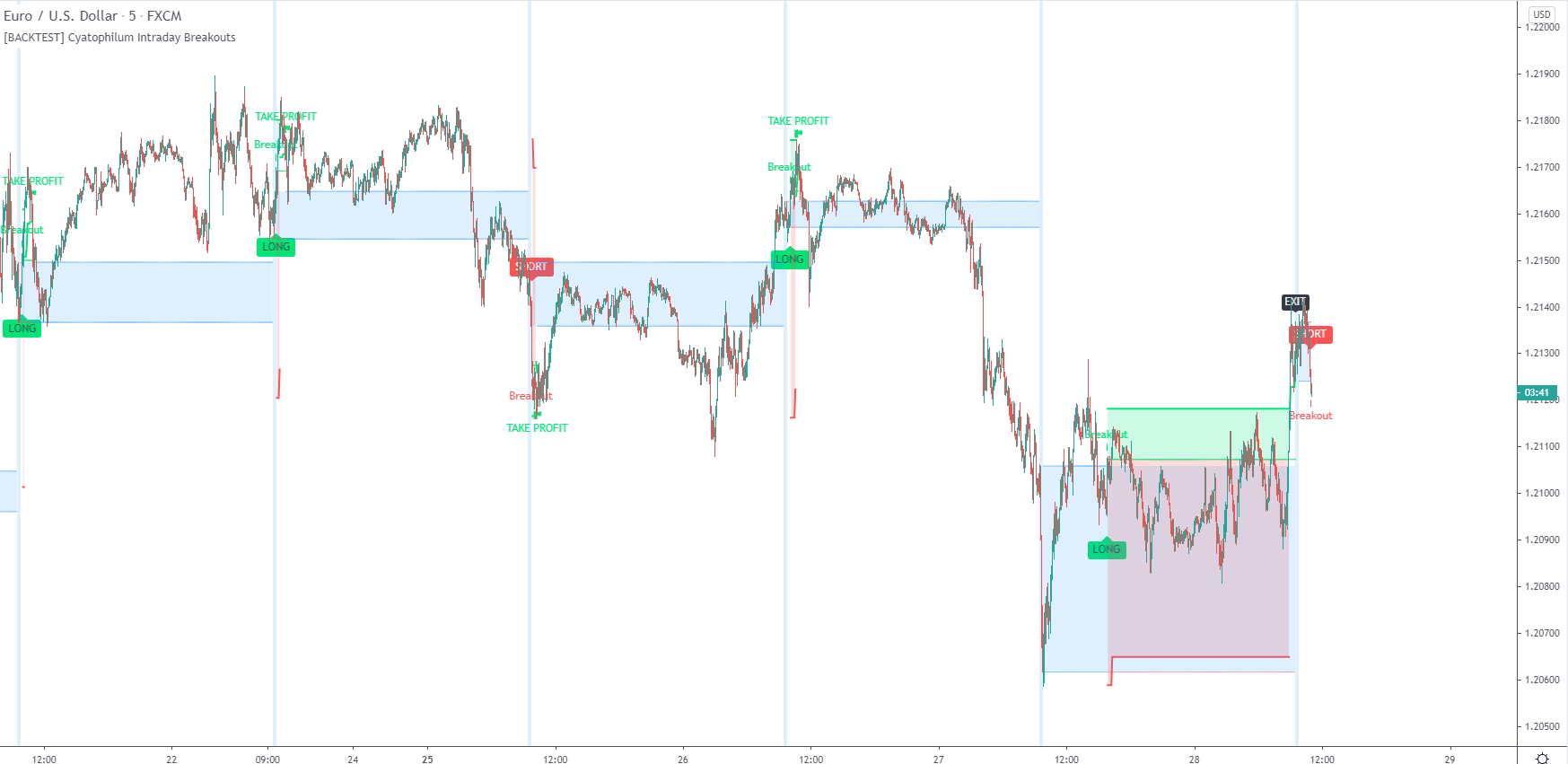

The Triple Screen Strategy

A multi timeframe strategy

This strategy is one of the famous writer and teacher Alexander Elder. It uses three different timeframes to decide wether to enter a trade or not. I explain it in detail in this post.

How to use

Configure the indicator settings to your liking. You can choose between 3 oscillators for the wave. The "Intraday resolution" setting is what will determine the high and low price level for a breakout.

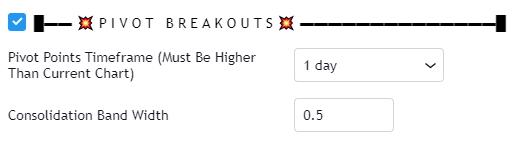

Pivots & Consolidation Breakouts

Trade Pivots and consolidation

The idea is to wait for price consolidation and a breakout to the top or the bottom will determine the direction of the trade.

How to use

Choose the timeframe for the pivot calculation, and the "consolidation band width" to increase or reduce the required price consolidation.

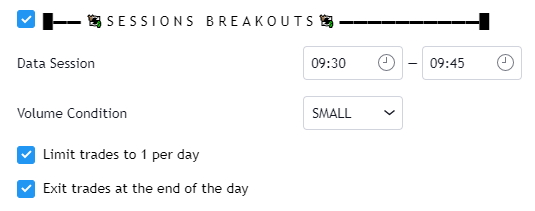

Sessions Breakouts

Prepare for a session breakout

On specific markets such as Forex or Stocks, we observe a huge volatility through a certain period of the day. We can take advantage of this information by waiting for a breakout using a range created just before the "rush hours".

How to use

Create a daily data session, that will be used to calculate the range for the breakout. You can use the volume condition to avoid fakeouts. I recommend to limit trades to 1 per day and to exit trades at the end of the day to avoid gaps.

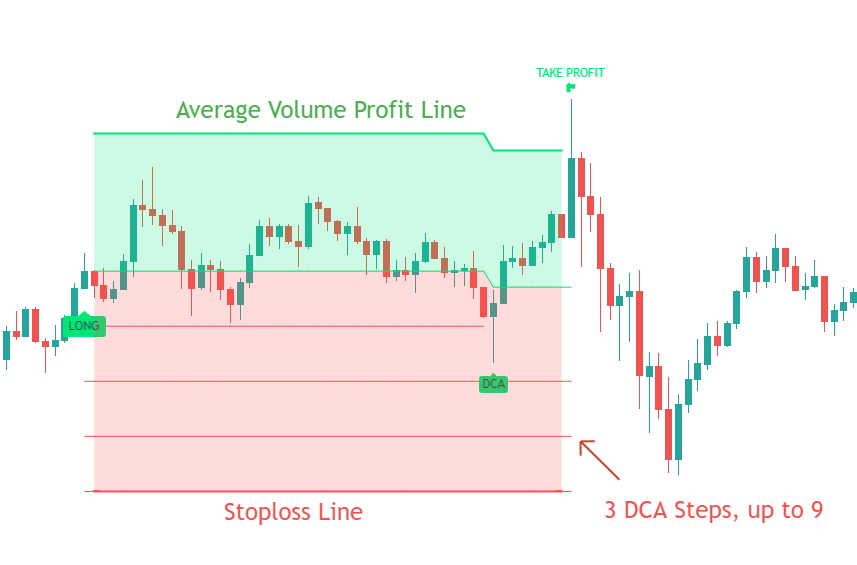

Risk Management

Stop Loss System

Stay safe. Configure your stop loss in TradingView! The integrated Stop Loss system will trigger an alert to exit the trade. You can secure your profits with the trailing system!

Take Profit System

Secure your gains. The integrated Take Profit system will trigger an alert to exit the trade. Use the Trailing Take Profit feature to make even more profits!

DCA

DCA stands for Dollar Cost Average. The idea is to open additional orders from the base order so as to improve risk management.

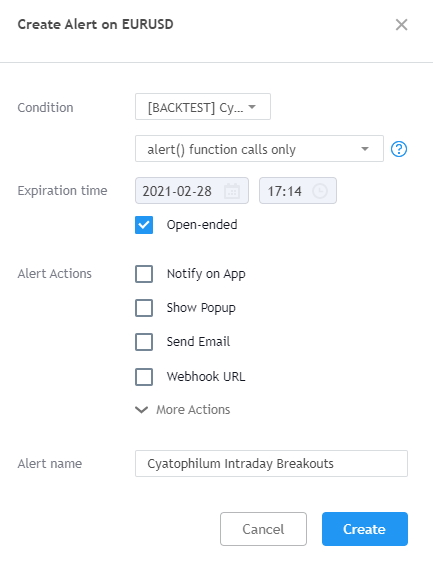

Backtesting and Alerts

Backtesting

The indicator uses TradingView's Strategy Tester to show results based on past trades. Use a realistic order size and commission to get realistic results.

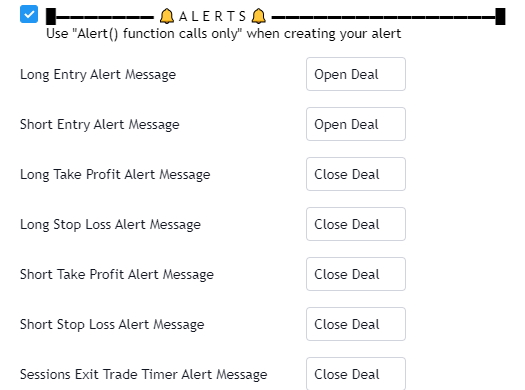

Automated Alerts

1. Write your alert messages in the indicator settings.

2. Click "Add Alert", select the indicator and "alert() function calls only" and you're done!

Private Discord Server: https://discord.gg/RVwBkpnQzm