How to Backtest 3Commas DCA Bots

Hello and welcome to this tutorial.

We are going to backtest 3 commas DCA bots using our TradingView indicator. Let's see how it works!

When you add the indicator to the chart, it will come up with default settings. You can change them by double clicking on the indicator name.

Let's start right away with a bot example. It will be a LTC/BTC short bot, and the timeframe we will use in TradingView is 1 minute. The timeframe should always be smaller or equal to the deal start conditions timeframes.

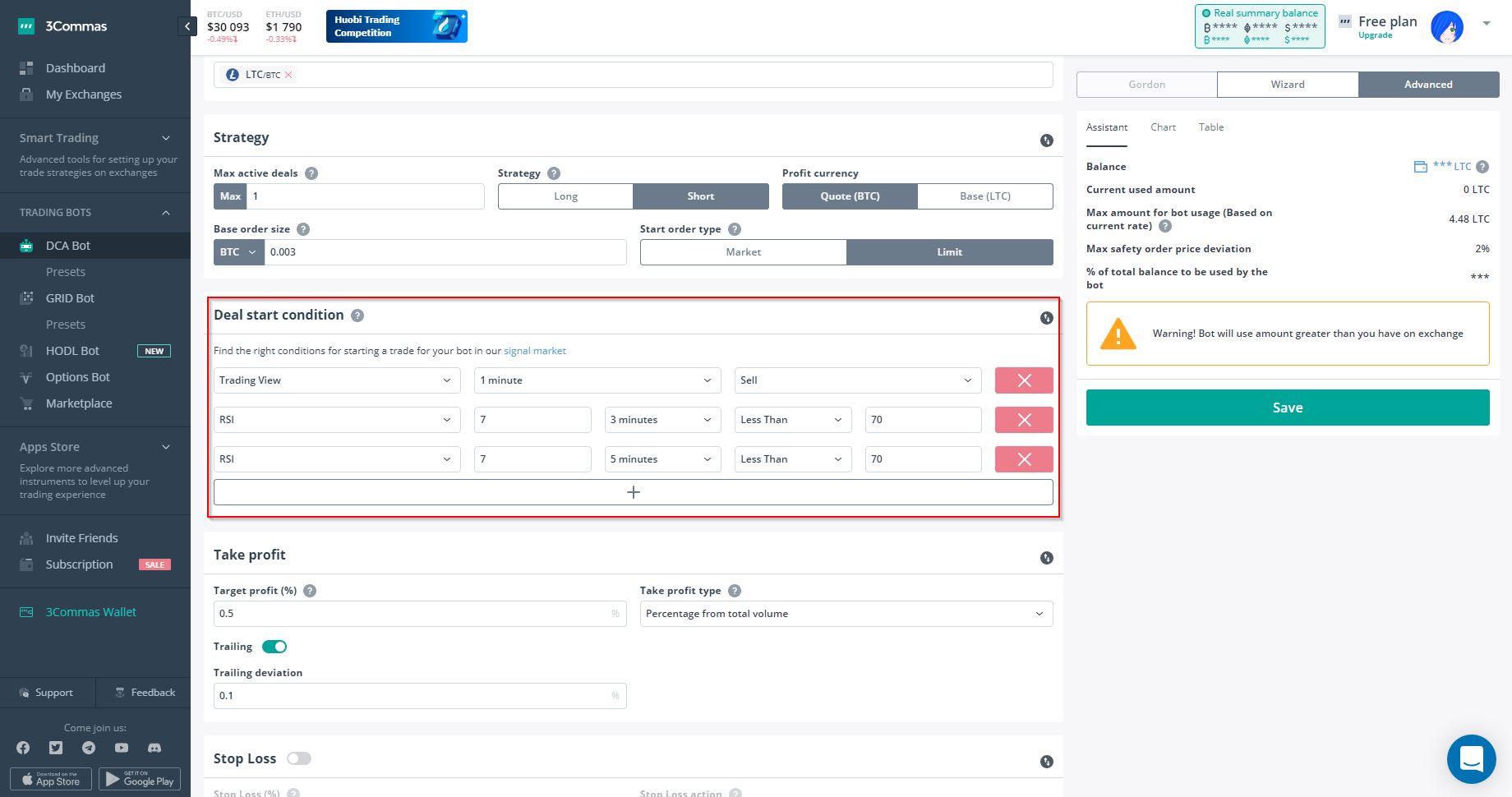

In 3Commas bot settings, you will find the Deal Start Condition section. Each combined condition will add up using a AND logical gate, meaning that all of them must be true in order to start a trade.

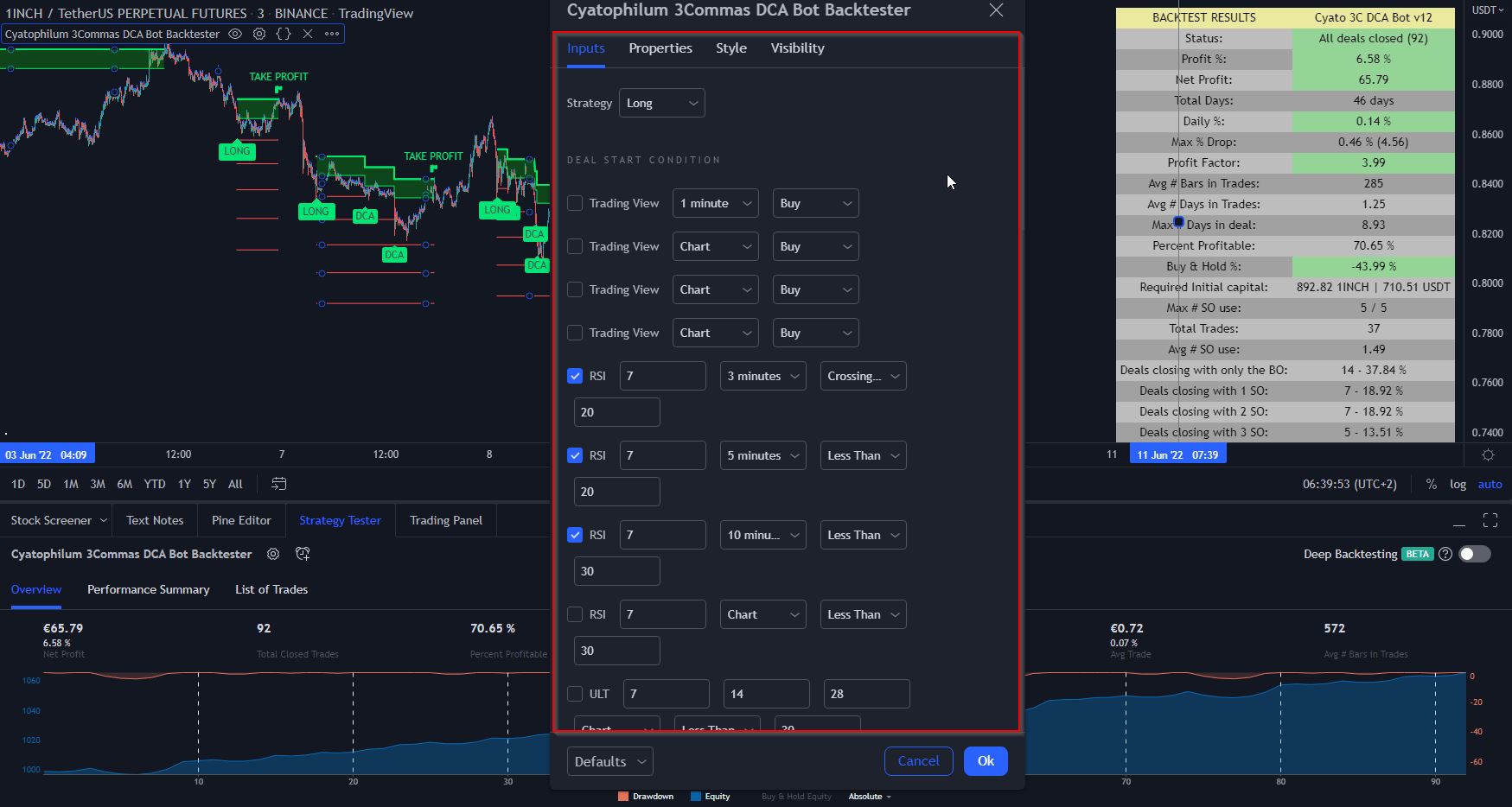

Let's replicate these settings in the indicator. Switch the Strategy to "Short", then set the Trading View 1 minute Sell and the two RSI conditions.

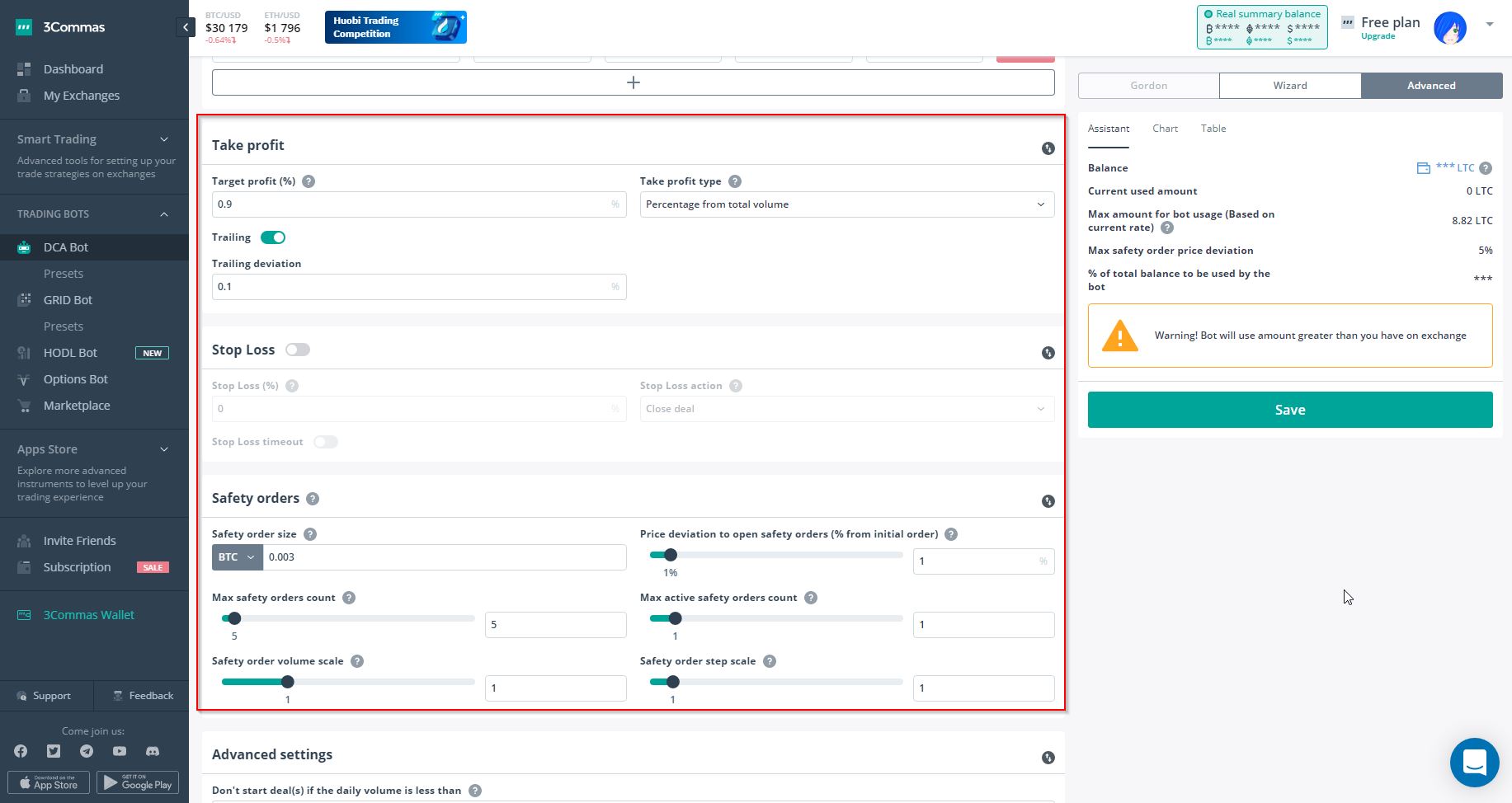

Next, check your Take Profit and Safety Orders settings in your bot. We have a 0.9% Target Profit with a trailing deviation of 0.1 and 5 safety orders of 0.003 BTC each in size.

Replicate them in the indicator. From the default settings, only the base order size and safety order size should be changed to 0.003 which correspond to the quote currency of the pair, BTC.

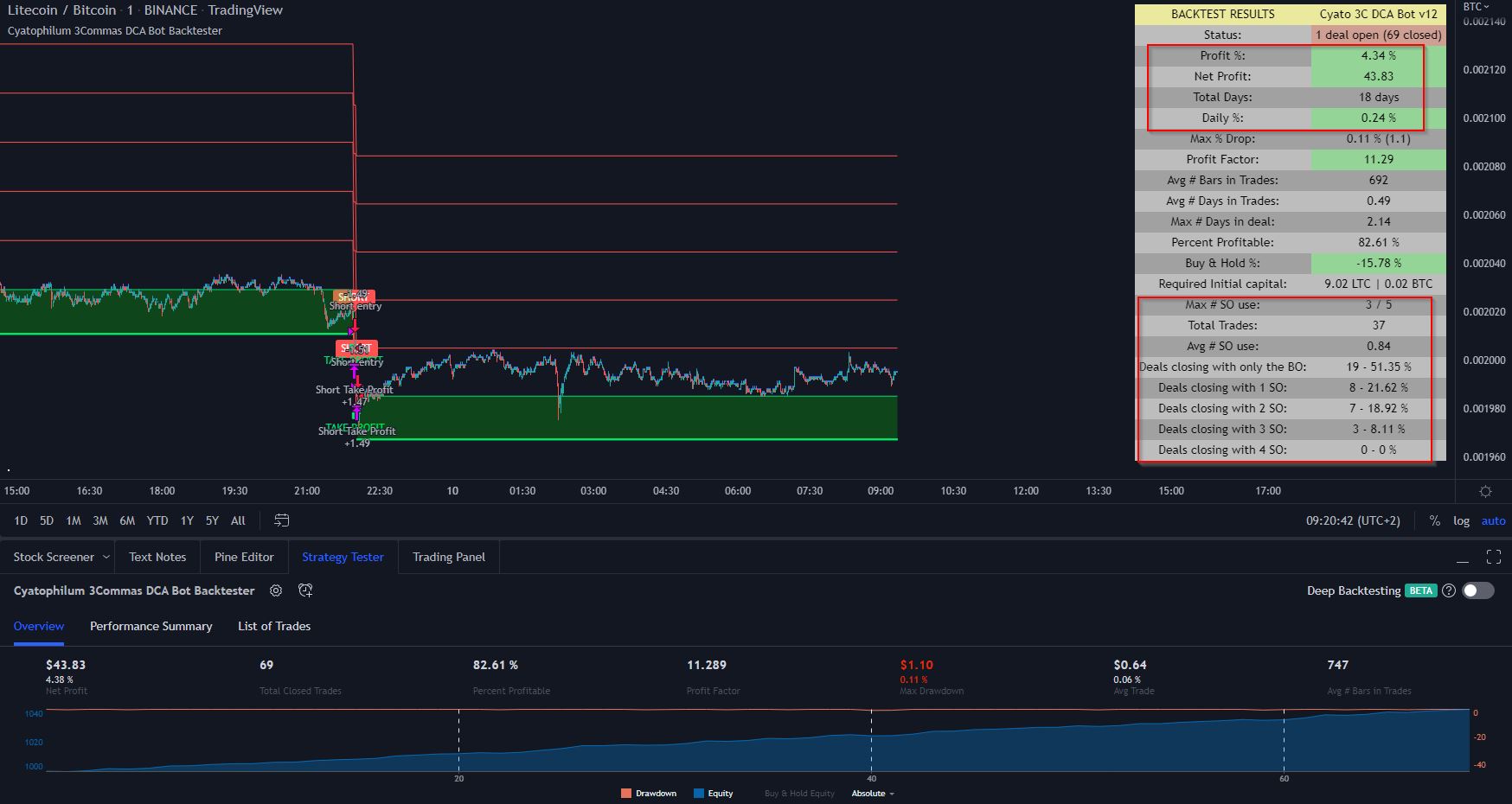

Now, we are almost done. In order to get realistic results, check the backtest panel to see the required initial capital. It is a total of 0.02 BTC with all orders added up. At the time of the video BTC is at 30 000 $ so 0.02 BTC would be around 600 $.

We round that up to 1000 $ and that will be our initial capital for our strategy. It is set in the Properties tab of the indicator settings.

We now have realistic results and for this example we can see that the backtest shows a 4 % profit in 18 days which his around 0.2 % daily. Only 3 safety orders out of 5 were used, and 50% of the deals closed with only the base order.

You can backtest further in the past with the Deep Backtesting feature which is currently in beta. It will not show the trades on the chart but the Strategy Tester will show the results of a much longer period. Here for example we backtest on 40+ days instead of 18 from the chart.

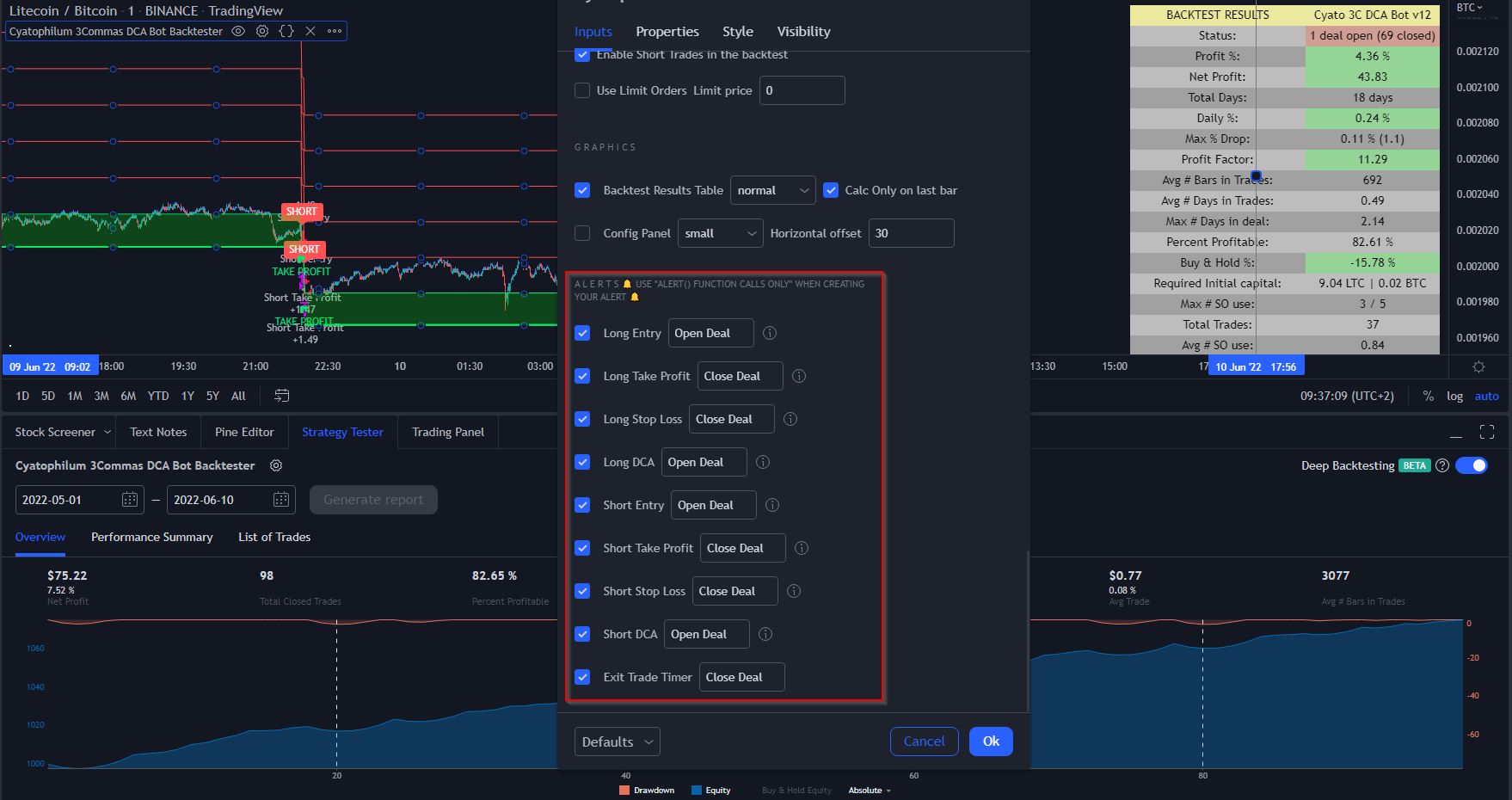

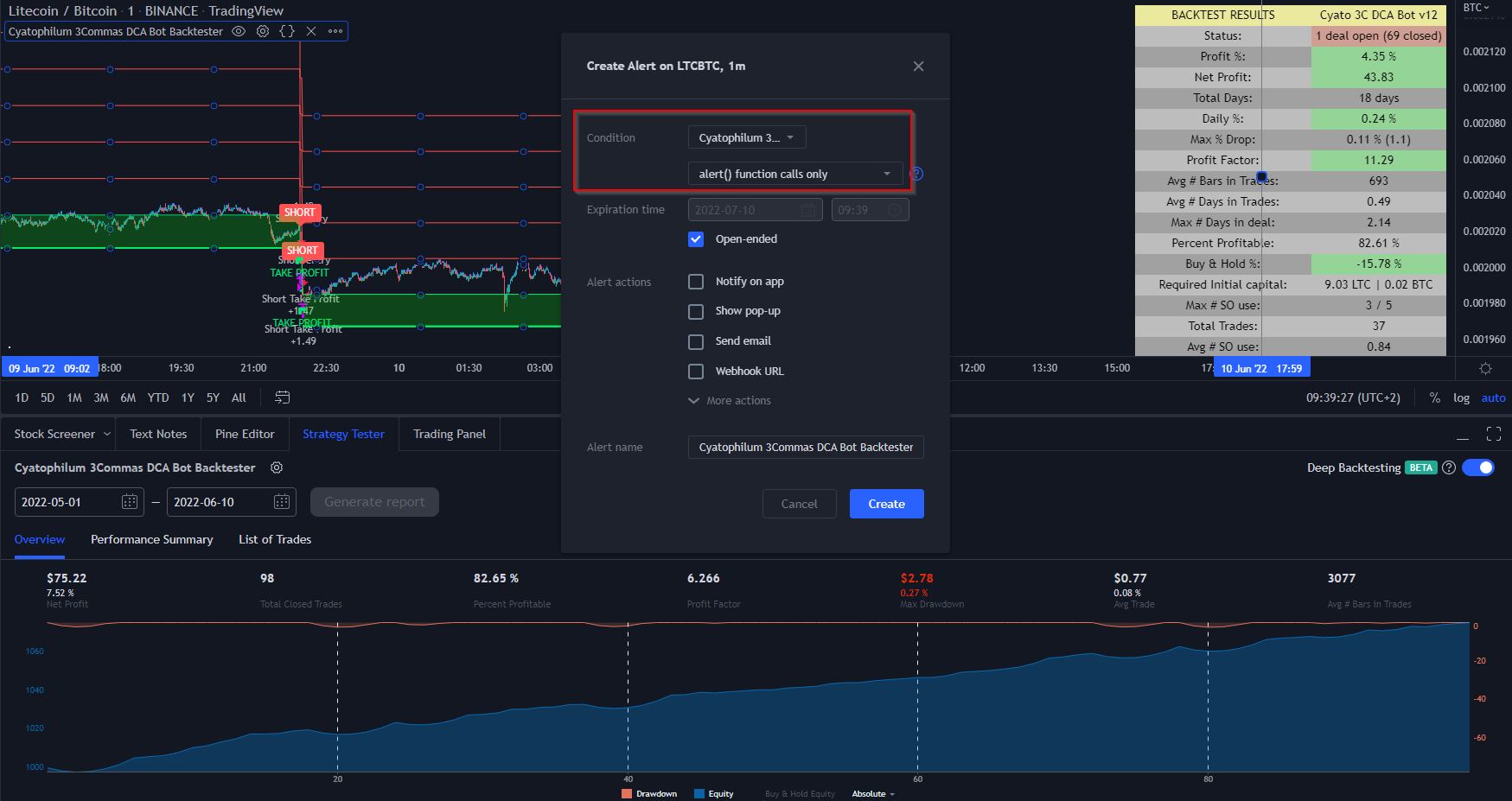

Now you can do more than just backtest. The indicator has an alert system built-in that you can use to create custom signals and such. The alert messages are written in the indicator inputs. Then, it only takes to create one alert to receive all the signals for entry, take profit, stop loss and safety order.

Make sure to use the condition "alert() function calls only" when creating your alert and that's it.

If you do not have access to the indicator and are interested in using it, please create an account at BlockchainFiesta.com.

Thanks for reading and see you in the next article!

Written by Cyatophilum - Created 2 years ago - Last edited 2 years ago

Recent Articles

Game Theory Optimal (GTO) strategies are commonly used in competitive games like poker, where the objective is to make decisions that are unexploitable by opponents. Applying GTO principles to trading involves creating strategies that minimize losses and maximize gains, regardless of market conditions or the actions of other market participants.

Optimal Play

Just like in poker, trading ...

I'm thrilled to announce the release of my latest tool – the Bitcoin Trend Indicator (BTI), and it's available for free on TradingView!Based on CoinDesk's research, the BTI is designed to help you easily identify and analyze Bitcoin trends. With multiple exponential weighted moving averages analysis and clear trend signals, it's a powerful addition to your trading toolkit.Ready to give it a try? ...

Hi Traders, in this short tutorial we will see how to autotrade on Binance.

Requirements

- A TradingView account with Webhooks notifications.

TradingView allows you to backtest your strategy and create alerts. For now, our bot page only works with TradingView alerts Webhook notifications.

Important: the Essential TradingView plan is required to unlock this feature. Without Webhooks, ...

As of May 23, 2024, Bitcoin (BTC/USDT) is experiencing some notable movements on the daily chart. Here's an in-depth technical analysis to provide insights into the current market conditions and potential future price actions.

Price Action and Key Levels

Current Price: $69,265.99 (down by 1.26% today)

Resistance Levels:

...