Market Analysis - April 5th

Huge triangle in formation on the S&P500. The short term indicators are bullish: we are above the 150 day and 200 weeks moving averages, both being used as support when price is above them.

Price has been contracting last few weeks and traders are waiting to pick a direction. The bearish target would be 2700$, a price we didn't see since the sanitary crisis. The bullish target would be a new all time high at 5270$. Let's see.

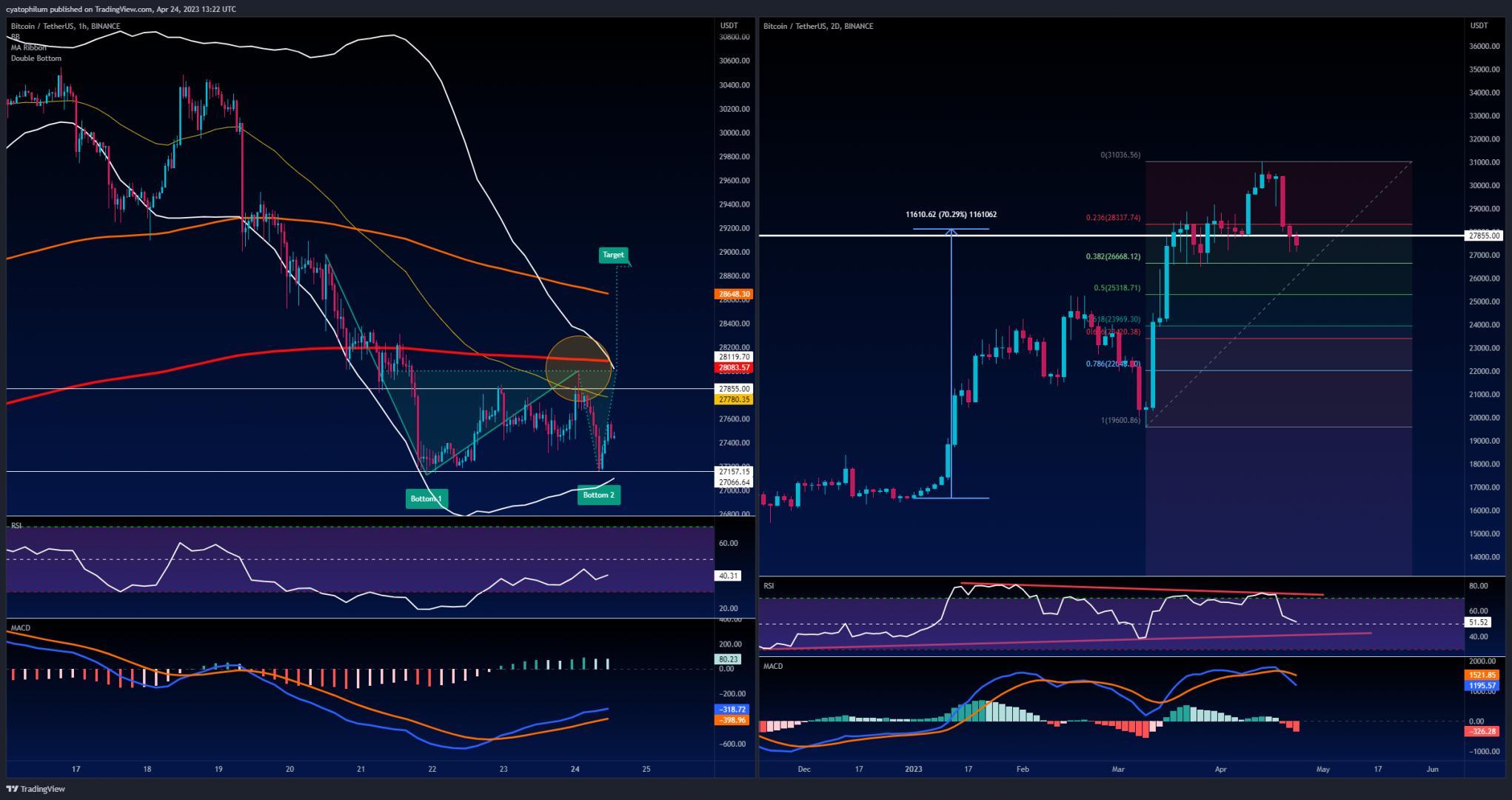

BTC: 2 weeks consolidation. Expecting lots of movements in case of breakout.

ETH: Outperforming BTC right now. Is often a catalyst in crypto markets. Cyato Bands moved its stop loss above break-even ?

Written by Cyatophilum - Created 1 year ago - Last edited 1 year ago

Log in or Sign in to leave a comment

Recent Articles

Coin Watch: Ethereum (ETH)

Let's start on the weekly and daily charts:The weekly shows an ascending wedge.A rising wedge is oft ...

Published 1 year ago

Read More

Coin Watch: Bitcoin

Hi guys, I've been thinking of how to make useful ideas, and here's what I came up with.I will be wa ...

Published 1 year ago

Read More

How to Use the Volume Divergence Indicator to Improve Your Trading Strategy

How to Use the Volume Divergence Indicator to Improve Your Trading StrategyAre you looki ...

Published 1 year ago

Read More

Market Cap Analysis: BTC Dominance Rejected, Alt Season Ahead?

In this article, we will analyze the current state of the cryptocurrency market through the ...

Published 1 year ago

Read More