Market Cap Analysis: BTC Dominance Rejected, Alt Season Ahead?

In this article, we will analyze the current state of the cryptocurrency market through the lens of market cap, BTC dominance, and major indices. We will also look at the potential for an alt season, the impact of the upcoming Bitcoin halving, and which coins are outperforming BTC in the long term. Finally, we will provide a short-term perspective on the price of Bitcoin.

First, let's have a look at market cap.

The BTC dominance was rejected by resistance at 49% with this reverted hammer candle on week of April 23. It could mean the market cap will flow into altcoins. And, on the right chart, the RSI is oversold and getting closer to the 50 mark which is, on this 2 weeks chart, an indicator of alt season.

Now, if we look at the Total market cap, we can see that it significantly grows after a bitcoin halving. The next one is just in 1 year, so be patient!

It's also important to look at major indices, since they can impact the price of the crypto market. The S&P 500 is currently trading in a triangle, and seem to bounce on the top of it these last days. It could mean more action to the downside.

Here is my "BTC destroyers" chart, and right now, only ETH and BNB, and maybe MATIC are outperforming bitcoin on the long term.

Here is a bear's perspective on Bitcoin: I like to compare Bitcoin and Nasdaq price as they are strongly correlated. A double top is forming on Nasdaq price and could be bad news for BTC price.

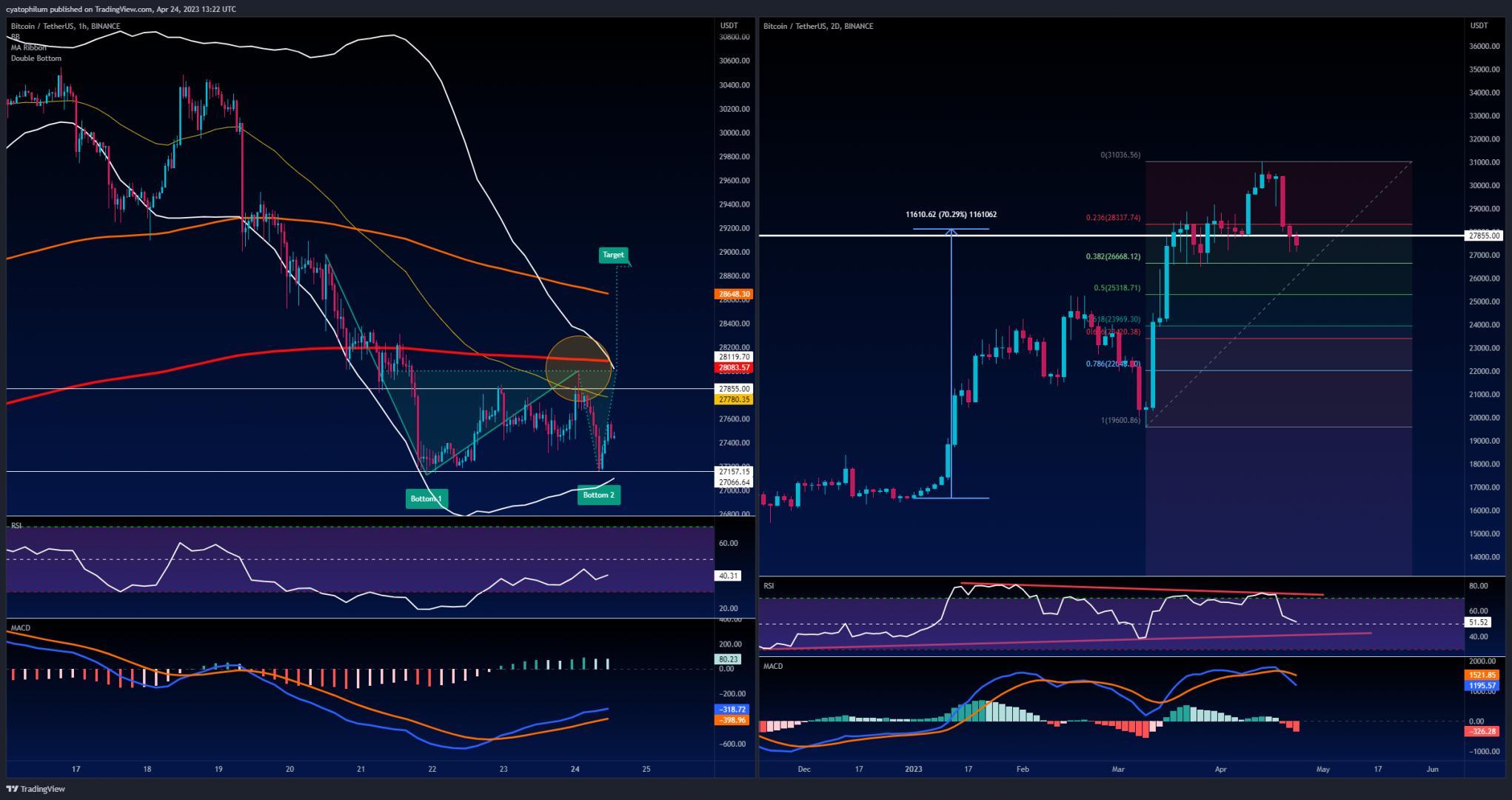

Now on the short term for Bitcoin: The 4 hour chart is printing a double bottom, it will be valid if price climbs back to 28 000$, the target will then be 28 880$. However the bigger trend is bearish, price currently below all moving averages, if price breaks below the bottom of last few day's range at 27 100$, next target for the bears is 26 660 given by fibonacci levels.

Written by Cyatophilum - Created 1 year ago - Last edited 1 year ago

Recent Articles

Game Theory Optimal (GTO) strategies are commonly used in competitive games like poker, where the objective is to make decisions that are unexploitable by opponents. Applying GTO principles to trading involves creating strategies that minimize losses and maximize gains, regardless of market conditions or the actions of other market participants.

Optimal Play

Just like in poker, trading ...

I'm thrilled to announce the release of my latest tool – the Bitcoin Trend Indicator (BTI), and it's available for free on TradingView!Based on CoinDesk's research, the BTI is designed to help you easily identify and analyze Bitcoin trends. With multiple exponential weighted moving averages analysis and clear trend signals, it's a powerful addition to your trading toolkit.Ready to give it a try? ...

Hi Traders, in this short tutorial we will see how to autotrade on Binance.

Requirements

- A TradingView account with Webhooks notifications.

TradingView allows you to backtest your strategy and create alerts. For now, our bot page only works with TradingView alerts Webhook notifications.

Important: the Essential TradingView plan is required to unlock this feature. Without Webhooks, ...

As of May 23, 2024, Bitcoin (BTC/USDT) is experiencing some notable movements on the daily chart. Here's an in-depth technical analysis to provide insights into the current market conditions and potential future price actions.

Price Action and Key Levels

Current Price: $69,265.99 (down by 1.26% today)

Resistance Levels:

...