4 bybit Swing Strategies

Is swing trading your thing? Do you also trade on Bybit? In this post I am sharing 4 strategies built with the Ultimate Trading Bot indicator, to be used in a 4 hours time frame.

BTC/USD Perpetual Futures Contract 240 BYBIT

In this strategy, the entries are created from the RSI divs and filtered by a 36 days Tilson T3 trend line, while the trades are guided by a trailing stop loss and take profit.

The backtest is the following. Note that Bybit being a recent exchange, we do not have as many data as usual.

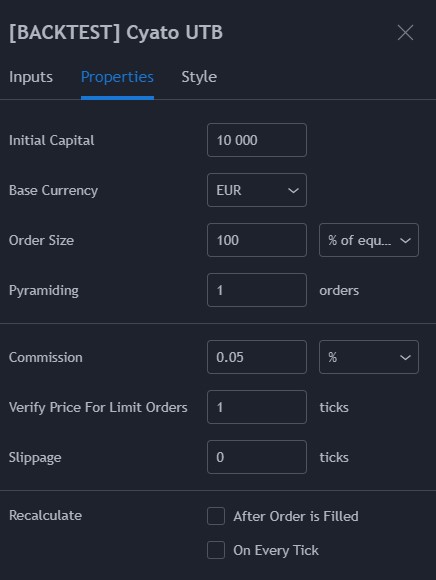

In all the strategies shared in this post, the backtest is calculated with an initial capital of 10 000$ and an order size of 100% equity, with a commission of 0.05% per trade.

Here is the configuration for this first strategy, I will explain how to create alerts at the end of the post.

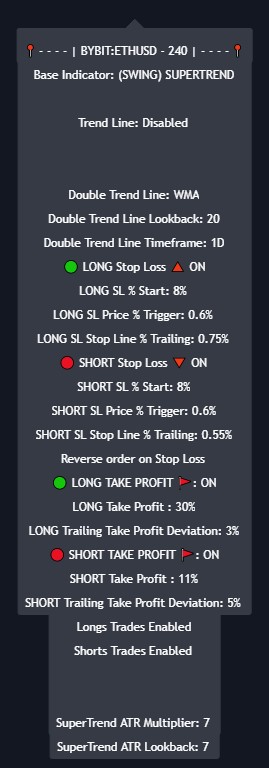

ETH/USD Perpetual Futures Contract 240 BYBIT

In this strategy, the entries are created from the Supertrend swings and filtered by a 20 days Weighted Moving Average. The trailing stop loss and take profit are set to a greedy Risk Reward ratio, 8:30 for longs and 8:11 for shorts, plus a reverse order on stop loss hit.

XRP/USD Perpetual Futures Contract 240 BYBIT

XRP is known for being tough to trade due to the main market leaders being banks, pushing the price randomly and fast. That is why I used the overbought and oversold signals from my RSI divs indicator combined with a 20 days Tilson Trend line to stay in the global trend. Here we set an aggressive trailing stop that will often hit in positive: those are the blue TSL labels.

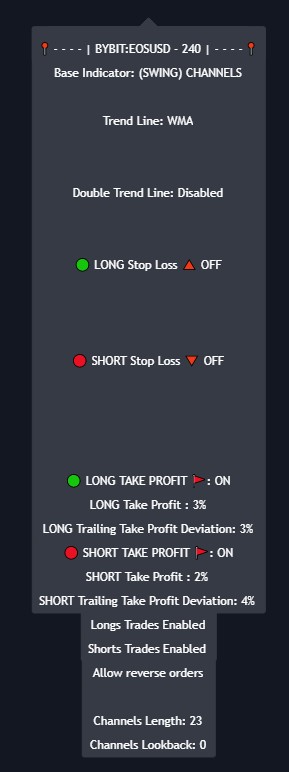

EOS/USD Perpetual Futures Contract 240 BYBIT

On this one I used the Channels entries, which is in fact a custom Donchian Channel. The bottom channel acts as a stop loss. A 3% take profit with trailing is set to catch quick profits.

Creating the alerts

If this is the first time you create an alert, then please read this article first.

To create the alerts for these strategies, I recommand creating a separate chart layout for each strategy. Then add the Alert Setup version of the Ultimate Trading Bot and replicate the settings or indicator arguments using the configurations given above. You can also do it with the Backtest version if you like to play with the Strategy Tester.

If you do not see what I am talking about, please read this article.

Once your chart layout is configured, if you can, save it. This is to make sure you will not change the settings after creating the alerts.

Note: Saving multiple chart layouts may be requiring a TradingView plan: 5 chars for pro, 10 for pro+ and unlimited for premium. You can ugrade your plan here.

For the BTC, ETH and XRP strategies you will need only 3 alerts.

- LONG ENTRY: enter long.

- SHORT ENTRY: enter short.

- ALL EXIT: exit all positions.

The EOS is a bit different since the order can reverse:

- LONG ENTRY: exit all positions AND enter long.

- SHORT ENTRY: exit all positions AND enter short.

- ALL EXIT: exit all positions.

If you need any help feel free to leave a comment or join the community on Discord!

Written by Cyatophilum - Created 4 years ago - Last edited today

Recent Articles

Game Theory Optimal (GTO) strategies are commonly used in competitive games like poker, where the objective is to make decisions that are unexploitable by opponents. Applying GTO principles to trading involves creating strategies that minimize losses and maximize gains, regardless of market conditions or the actions of other market participants.

Optimal Play

Just like in poker, trading ...

I'm thrilled to announce the release of my latest tool – the Bitcoin Trend Indicator (BTI), and it's available for free on TradingView!Based on CoinDesk's research, the BTI is designed to help you easily identify and analyze Bitcoin trends. With multiple exponential weighted moving averages analysis and clear trend signals, it's a powerful addition to your trading toolkit.Ready to give it a try? ...

Hi Traders, in this short tutorial we will see how to autotrade on Binance.

Requirements

- A TradingView account with Webhooks notifications.

TradingView allows you to backtest your strategy and create alerts. For now, our bot page only works with TradingView alerts Webhook notifications.

Important: the Essential TradingView plan is required to unlock this feature. Without Webhooks, ...

As of May 23, 2024, Bitcoin (BTC/USDT) is experiencing some notable movements on the daily chart. Here's an in-depth technical analysis to provide insights into the current market conditions and potential future price actions.

Price Action and Key Levels

Current Price: $69,265.99 (down by 1.26% today)

Resistance Levels:

...