Grow in USDT - Quick Setup

In this post we are going to use the Cyato H.A. Swing indicator to create a lot of buy & sell strategies very quickly, while making sure we beat the Buy & Hold return with the backtest. We will be focusing on Binance USDT markets, the goal will be to grow in USDT with automated signals. We will also make a top 10 of the best coins who had the best results.

The indicator

The Cyato H.A. Swing indicator might not have a stop loss and take profit system like my latest indicator but it is really good when you want to create good Buy & Sell strategies very quickly and without spending any time tweaking some kind of settings.

How to use

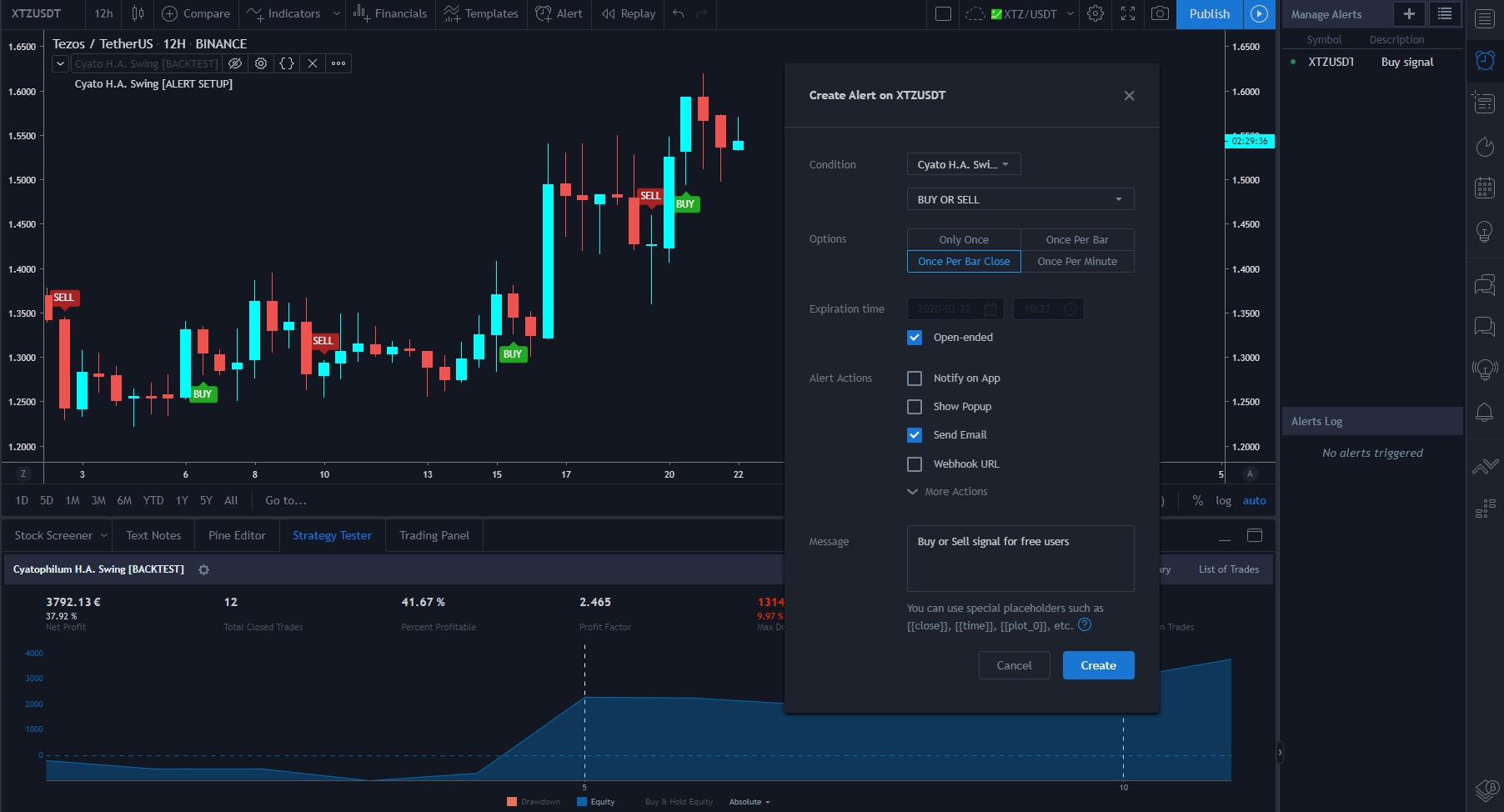

Basically, once you know the timeframe and parity you want to trade, all it takes is to add the indicator on your chart, create a buy and a sell alert, and that's it.

There is a "Buy or Sell" signal in one alert to save up on the alert count.

Make sure to always use the regular candles (for backtesting and creating alerts)

How to backtest

You can backtest using the Backtest version of the indicator. You must be on regular candles. Since the indicator has no input parameter or settings, the goal will be to find the best timeframe for each parity.

Using the Strategy Tester, we will look for the timeframe with best Net Profit and lowest Max Drawdown. Also the Strategy Equity should be greater than the Buy & Hold return.

The Strategies

I took the USDT markets of Binance, ordered by market capitalization, and backtested them. This results in the list below.

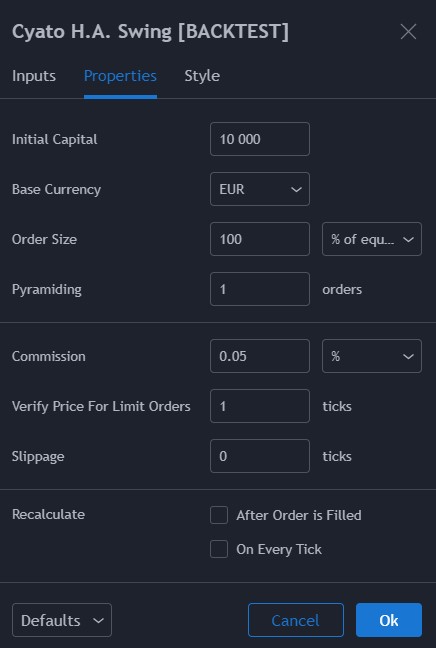

Backtest parameters

To get a clear picture, I backtested all the pairs on the same time period, from the year 2019 in january to today which is the 22th january 2020. The results include only long trades with no leverage, as in a successive Buy and Sell order. The initial capital used for the backtest is 10 000$, and for each trade we use an order size of 100% equity, with a 0.05% commission on each trade.

List

Here is the list ordered by market capitalization.

| Parity USDT | Timeframe | Net Profit % | Max Drawdown % | Nb Trades |

|---|---|---|---|---|

| BTC | 8H | 165 | 8 | 43 |

| ETH | 1D | 53 | 24 | 13 |

| BCH | 8H | 30 | 5 | 6 |

| LTC | 2D | 111 | 23 | 6 |

| EOS | 1W | 46 | 28 | 2 |

| BNB | 1W | 332 | 0 | 1 |

| XLM | 4H | 57 | 29 | 100 |

| ADA | 1W | 90 | 0 | 1 |

| TRX | 4H | 50 | 30 | 101 |

| ETC | 1W | 64 | 0 | 1 |

| DASH | 8H | 186 | 15 | 38 |

| LINK | 12H | 393 | 19 | 30 |

| ATOM | 2D | 61 | 6 | 4 |

| NEO | 1D | 61 | 7 | 12 |

| ONT | 6H | 111 | 31 | 67 |

| VET | 4D | 80 | 2 | 3 |

| ZEC | 8H | 91 | 28 | 35 |

| QTUM | 1D | 76 | 10 | 15 |

| ZRX | 2D | 45 | 6 | 3 |

We can see that each pair performs better on a specific timeframe, indeed depending on volume and volatility, the market cycles are different.

Top 10 pairs

If we order the list by Net Profit, this is what we get.

| Parity USDT | Timeframe | Net Profit % | Max Drawdown % | Nb Trades |

|---|---|---|---|---|

| LINK | 12H | 393 | 19 | 30 |

| BNB | 1W | 332 | 0 | 1 |

| DASH | 8H | 186 | 15 | 38 |

| BTC | 8H | 165 | 8 | 43 |

| LTC | 2D | 111 | 23 | 6 |

| ONT | 6H | 111 | 31 | 67 |

| ZEC | 8H | 91 | 28 | 35 |

| ADA | 1W | 90 | 0 | 1 |

| VET | 4D | 80 | 2 | 3 |

At the first place, LINK/USDT

Coming next: BTC markets!

Written by Cyatophilum - Created 4 years ago - Last edited today

Recent Articles

Game Theory Optimal (GTO) strategies are commonly used in competitive games like poker, where the objective is to make decisions that are unexploitable by opponents. Applying GTO principles to trading involves creating strategies that minimize losses and maximize gains, regardless of market conditions or the actions of other market participants.

Optimal Play

Just like in poker, trading ...

I'm thrilled to announce the release of my latest tool – the Bitcoin Trend Indicator (BTI), and it's available for free on TradingView!Based on CoinDesk's research, the BTI is designed to help you easily identify and analyze Bitcoin trends. With multiple exponential weighted moving averages analysis and clear trend signals, it's a powerful addition to your trading toolkit.Ready to give it a try? ...

Hi Traders, in this short tutorial we will see how to autotrade on Binance.

Requirements

- A TradingView account with Webhooks notifications.

TradingView allows you to backtest your strategy and create alerts. For now, our bot page only works with TradingView alerts Webhook notifications.

Important: the Essential TradingView plan is required to unlock this feature. Without Webhooks, ...

As of May 23, 2024, Bitcoin (BTC/USDT) is experiencing some notable movements on the daily chart. Here's an in-depth technical analysis to provide insights into the current market conditions and potential future price actions.

Price Action and Key Levels

Current Price: $69,265.99 (down by 1.26% today)

Resistance Levels:

...