How to create an accumulation bot

In this article we will see how to create an accumulation strategy bot in 4 simple steps.

Requirements:

- A Cyatophilum Indicators subscription. The subscription includes access to the indicators and the Binance bots.

- A Binance account. You create one here.

How does the strategy works?

The strategy takes advantage of the volatility of the market. It will buy several times when the price is low, and sell everything when the total bought volume is in profit. Instead of using a stop loss and selling in loss when the price drops, the strategy will buy more and wait until price climbs back up. We are kind of trading time against losses.

In my examples I will not use a stop loss because I do not want to sell in loss, but note that the indicator has a stop loss feature too.

To prevent buying at the top or in a bear market and staying stuck for too long in a trade, the indicator comes with several filters such as a trend filter, volume or RSI filter.

Here is how a strategy typically looks like:

Step 1: Configuring the strategy

Optional step: Backtesting

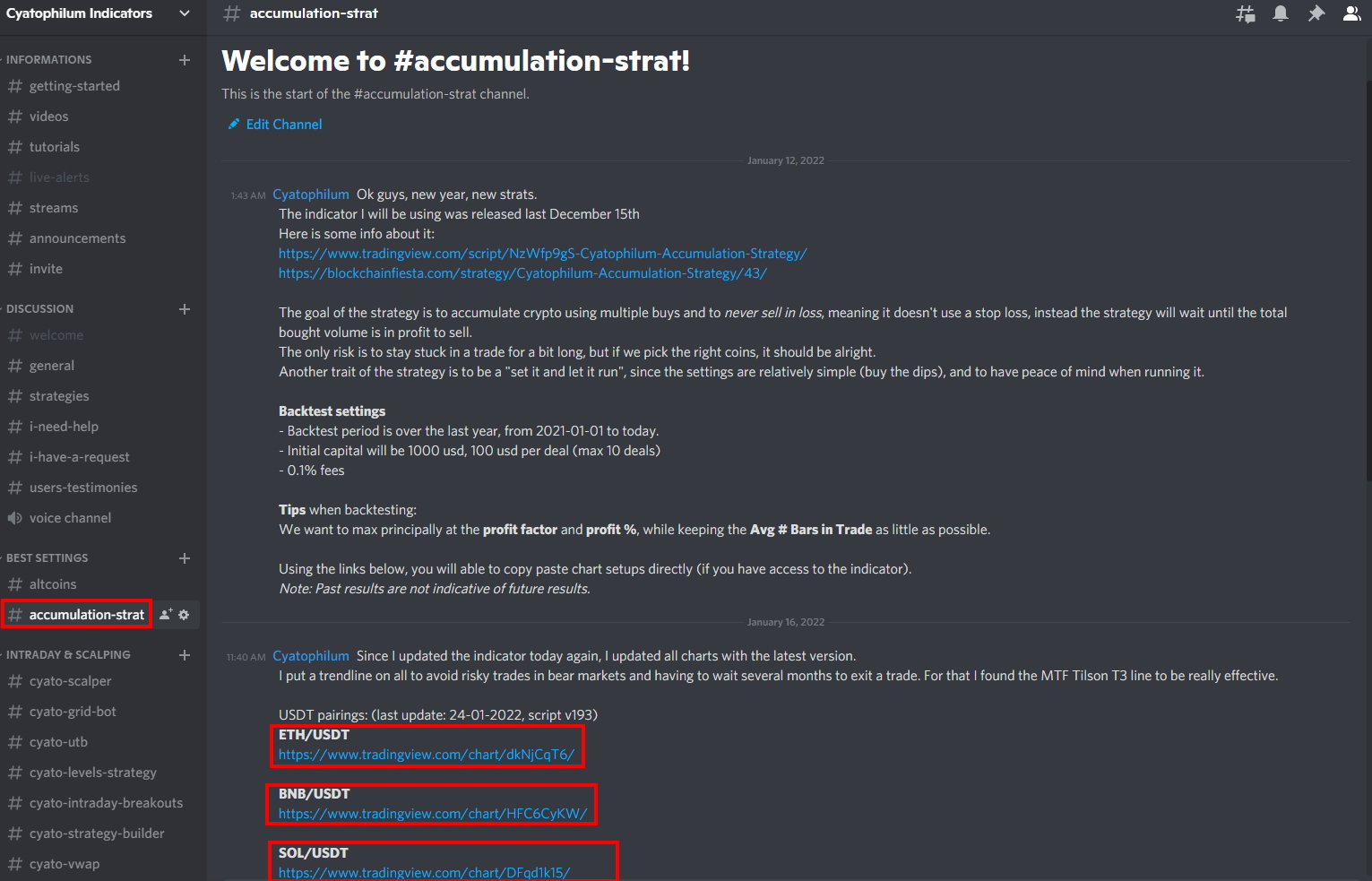

This step is optional, because I am sharing pre-configured strategies in my discord server that you can copy and use/edit for yourself.

When backtesting, the goal is to play around with the indicator settings until we are satisfied with the backtest results.

The backtest panel will give additional information to the strategy tester.

We mainly want to look at the profit % or net profit, the Avg # Days in trades - which is the average number of days a trade takes, the Max # Days in deal - the maximum number of days a trade took.

For this tutorial, I will be using this strategy:

If you are subscribed, you can directly copy the chart using this link: https://www.tradingview.com/chart/mXVoDgau/

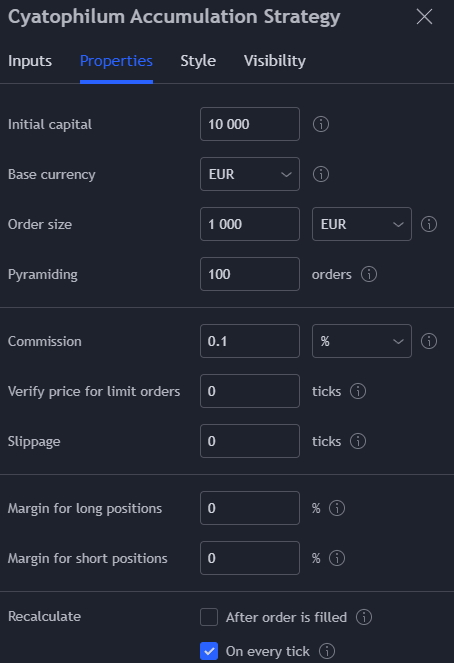

The backtest parameters are the following:

The strategy has a required initial capital of 10 000 USDT. It will buy using 1000 USDT up to 10 times, and sell everything on take profit.

You could lower these amounts to fit your needs. Simply note that the minimum order size on Binance is around 10 USDT.

Step 2: Create the Binance Bot.

Go to My Binance Bots page. If this is your first time doing this, you will need to configure your API settings. Follow this tutorial for that.

Once you can see your Binance account balances, it means your are successfully set up.

You can now create a bot by clicking the "create bot" button.

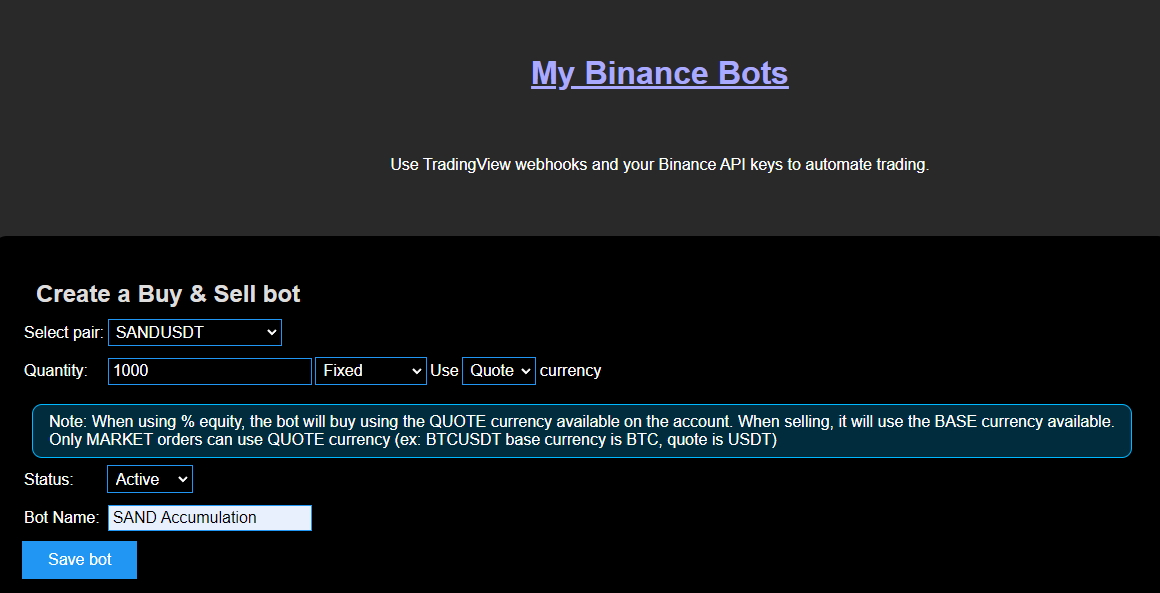

Create your bot like the following: select the pair, in our example, SANDUSDT.

Set the quantity. Important: make sure to use "quote" currency.

Give your bot a name and click save.

Now that we created our bot, nothing will happen yet. In "your bots" list, click "edit" to open the bot page.

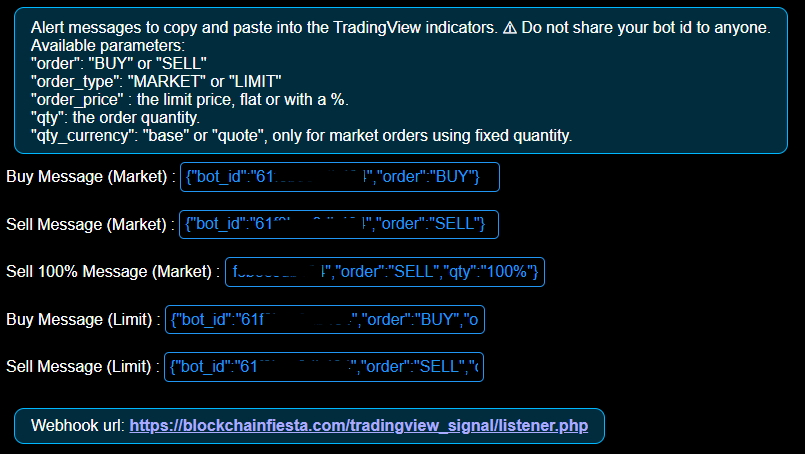

We need to use two alert messages. One for buying using 1000 USDT. One for selling everything.

The buy message is the first one on the list: "Buy Message (Market)"

The sell message is the third one on the list: "Sell 100% Message (Market)"

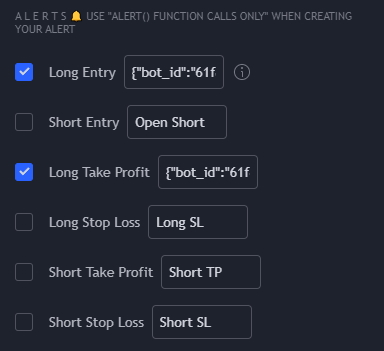

Step 3: Finish configuring the indicator

Open the indicator settings.

Copy and paste the two alert messages like this:

In the "Long Entry" text field, paste the buy message.

In the "Long Take Profit" text field, paste the sell message.

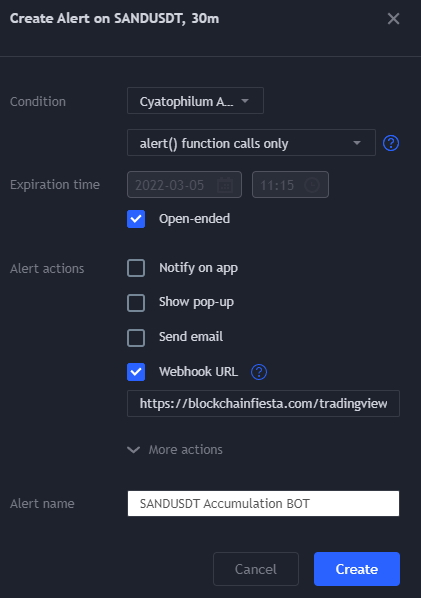

Step 4: Create the alert

The strategy requires one single alert to create.

Click "Add alert on Cyatophilum Accumulation Strategy".

It will open a popup window.

IMPORTANT: Switch the condition to "alert() function calls only". Set the webhook url to "https://blockchainfiesta.com/tradingview_signal/listener.php"

Give your alert a name.

Click create.

You are done!

I recommend to save your chart layout. If at any time you want change an indicator setting, you have to delete the alert and create it again. The alert save the indicator configuration at the moment you create it, an alert is basically a copy snapshot of the indicator.

You can track your strategy by coming back to your chart, in the alert logs and in the bot logs. If you have any question you can send me a private message in Discord or TradingView.

Written by Cyatophilum - Created 2 years ago - Last edited today

Recent Articles

What if instead of buying a stock, crypto, currency on ...

Let's start on the weekly and daily charts:The weekly shows an ascending wedge.A rising wedge is oft ...

Hi guys, I've been thinking of how to make useful ideas, and here's what I came up with.I will be wa ...

How to Use the Volume Divergence Indicator to Improve Your Trading StrategyAre you looki ...