Alerts are now simpler to create!

Until now we have been struggling with two versions of each indicator in order to do two specific things: backtesting and automating alerts. Most of the time we started by backtesting the indicator and then replicating all its settings on the alert version, which was a process that took time and could lead to errors.

I am happy to say that this process now belongs to the past!

Indeed, finally, thanks to a new system brought by TradingView, it now only takes one indicator to do the backtesting and it only takes one alert count to receive automated alerts for all events. Let's dive into this. You will see, it's quite simple for once!

One indicator, One alert

Let's see how to automate the alerts with the new system.

We do not need the "[AlertSetup]" version of the indicators anymore, since the "[Backtest]" is now doing all the work!

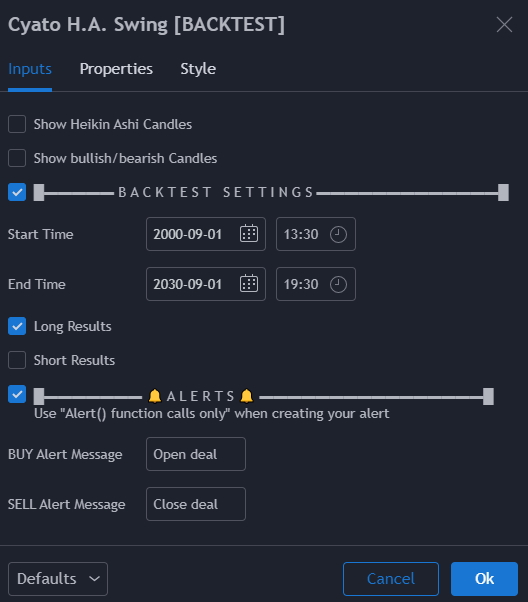

Starting with a simple example, using Cyato H.A. Swing indicator, which is a really simple one to use.

On the ADA/USDT chart in 1 Day timeframe, it looks like this:

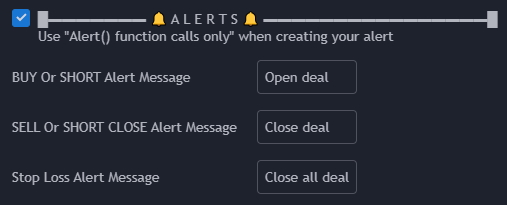

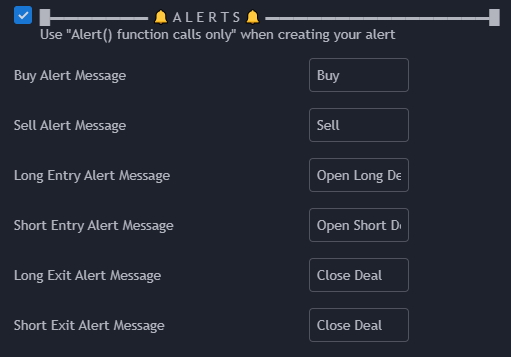

Open the indicator's settings. We can see the usual indicator parameters, and at the bottom you will find a section with alerts text fields. This is where you write your alert message. If you use a bot, this is where you paste the order command.

In this strategy, there are only 2 events: Buy and Sell. The new alert system only require to create one alert to receive alerts for all events! If the strategy had more event, as we are going to see with other indicators, it would still require only one alert.

This new system save up on the alert count. This is huge as it could mean that you could switch to a less expensive TradingView plan.

Creating the alert

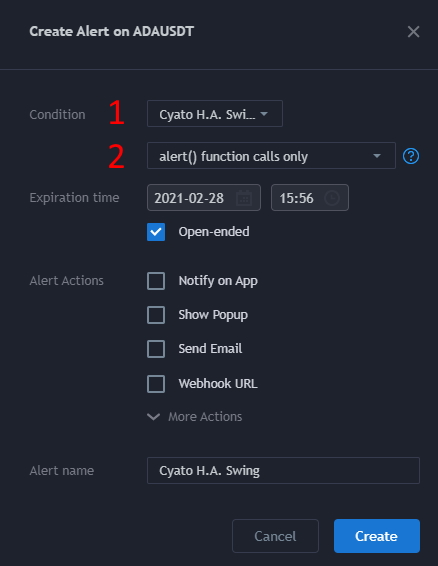

To actually create the alert, click "Add alert" or "Create alert" or hit Alt + A.

A pop-up window appears. Make sure in the condition section that the indicator is selected, and in the drop-down menu, select the following "alert() function calls only"

Then choose a name for you alert. This name will be displayed in the alert log. Finally click Create.

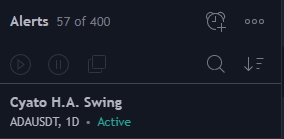

To see if you alert was created successfully, open the alert management tab on the right. It should appear like this:

As usual with alerts, they save the configuration of the indicator at the moment you create them. If you want to change the strategy: an indicator setting or the chart timeframe, you need to delete and create the alert again.

Indicators Alerts Tutorial

Let's see what there is to know with each indicator.

Cyatophilum Grid

For this example, we are going to use the default settings on the BTC/USDTPERP chart in 5 minutes timeframe.

The strategy has only 3 events for now. BUY and SELL for a long strategy, SHORT and CLOSE for a short strategy, and STOPLOSS.

The first command is meant to open one deal, the second to close one deal, and the third to close all deals. You can use it differently if you want though!

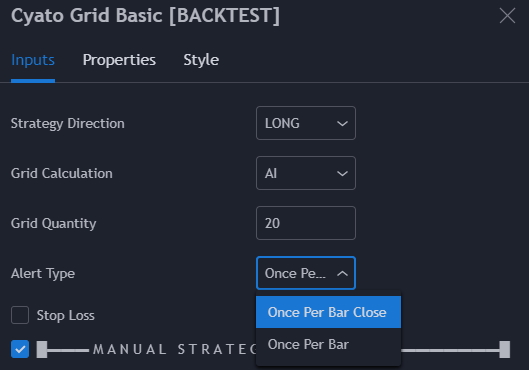

One thing to note, is that the alerts can happen either intra-bar (once par bar) or at bar close (once per bar close). This is automatically set by the indicator setting "alert type".

As you can see, the "Once Per Bar" or "Once Per Bar Close" option no longer needs to be set in the alert creation window. The indicator is doing the job itself.

Cyatophilum Intraday Breakouts, Scalper, Swing Trader or Ultimate

Here we will be using Cyatophilum Intraday Breakouts with the Session Breakouts strategy using the following settings:

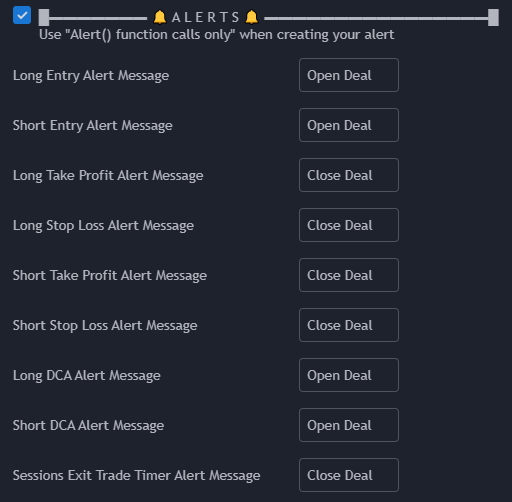

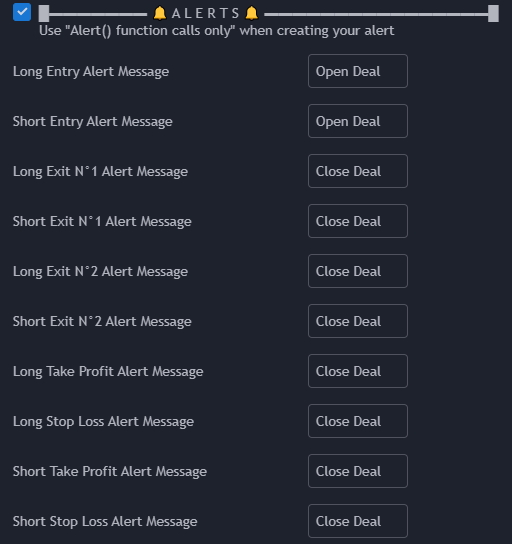

Here aswell and for all indicators, open the indicator settings to write your alert messages. The events that are not used in your strategy, for example DCA, will not be triggered, so you can leave their text field empty or just leave it as it is by default.

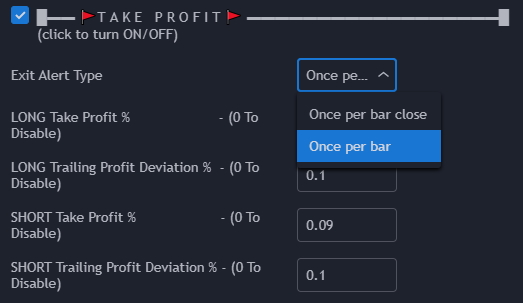

On indicators featuring Stoploss and Take profit, the alert for these event will trigger "Once Per Bar" or "Once Per Bar Close" accordingly to what you set in the indicator "Exit alert type" parameter.

Cyatophilum SuperTrend

The indicator Cyatophilum SuperTrend offers to go with a simple Buy Sell strategy or a double Supertrend with Long and Shorts and exits.

Simply write the order message for the events that your strategy uses.

Cyatophilum Levels

Here is example of strategy using Cyatophilum Levels with the following settings:

Since the strategy has 2 different exits possible from fibonacci levels, we find the corresponding text fields. Most of the time you will just send a "close deal" command, but if you wanted to do things differently, you could!

Conclusion

The alert creation process is now easier and faster. We do not need to setup an "alert" version anymore. No more need to double set the "once per bar" and "once per bar close" option as it is set only once in the indicator. It only takes one alert to receive alerts for all events in the strategy.

If you need further help, you can always message me on Discord (you will find a link in your account if you haven't joined yet).

If I forgot something, you can leave a comment.

Thank you for reading, and happy trading!

Written by Cyatophilum - Created 3 years ago - Last edited today

Recent Articles

What if instead of buying a stock, crypto, currency on ...

Let's start on the weekly and daily charts:The weekly shows an ascending wedge.A rising wedge is oft ...

Hi guys, I've been thinking of how to make useful ideas, and here's what I came up with.I will be wa ...

How to Use the Volume Divergence Indicator to Improve Your Trading StrategyAre you looki ...