BTC market Swing Strategies

In this article I will show the backtest results of the Cyato H.A. Swing indicator on Binance BTC markets, and make a TOP 8 most profitable coins of 2018-2019.

Most altcoins have been performing badly in 2019 with the bear market, making it hard for a Buy & Sell strategy to be profitable. However I managed to list 20 coins with which the strategy was profitable, and we will see that there are some coins who did surprisingly well.

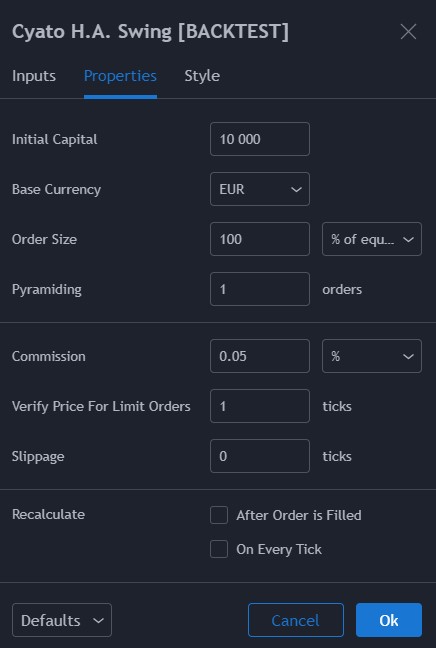

Backtest parameters

To get a clear picture, I backtested all the pairs on the same time period, from the year 2018 in january to today which is the 22th january 2020. The results include only long trades with no leverage, as in successive Buy and Sell orders. The initial capital used for the backtest is 10 000$, and for each trade we use an order size of 100% equity, with a 0.05% commission on each trade.

When backtesting a BTC parity, the Net Profit % is the percentage amount of your BTC equity that you earned during the whole backtest time period. It does not takes the BTC/USD price fluctuations into account.

List

Here is the list ordered by market capitalization.

| Parity BTC | Timeframe | Net Profit % | Max Drawdown % | Nb Trades |

|---|---|---|---|---|

| ETH | 8H | 148 | 29 | 74 |

| EOS | 4D | 54 | 23 | 7 |

| XRP | 4D | 3 | 16 | 4 |

| LTC | 3D | 34 | 19 | 8 |

| BNB | 1D | 73 | 19 | 13 |

| XLM | 8H | 18 | 39 | 89 |

| ADA | 2D | 11 | 40 | 14 |

| TRX | 3D | 238 | 16 | 5 |

| XTZ | 12H | 65 | 13 | 9 |

| LINK | 2D | 382 | 30 | 13 |

| ATOM | 8H | 118 | 27 | 29 |

| ONT | 12H | 542 | 39 | 50 |

| VET | 5D | 85 | 9 | 3 |

| BAT | 2D | 36 | 35 | 12 |

| HOT | 3D | 173 | 8 | 5 |

| WAVES | 1W | 46 | 2 | 2 |

| ZEN | 1D | 70 | 36 | 20 |

| MCO | 1D | 48 | 33 | 26 |

| ENJ | 3D | 308 | 27 | 9 |

| IOST | 4D | 140 | 0 | 3 |

Top 8 Most profitable coins

To get this Top 8, I sorted the list by descending Net Profit %.

| Parity BTC | Timeframe | Net Profit % | Max Drawdown % | Nb Trades |

|---|---|---|---|---|

| ONT | 12H | 542 | 39 | 50 |

| LINK | 2D | 382 | 30 | 13 |

| ENJ | 3D | 308 | 27 | 9 |

| TRX | 3D | 238 | 16 | 5 |

| HOT | 3D | 173 | 8 | 5 |

| ETH | 8H | 148 | 29 | 74 |

| IOST | 4D | 140 | 0 | 3 |

| ATOM | 8H | 118 | 27 | 29 |

In the previous post I backtest the USDT markets..

Thanks for reading!

Written by Cyatophilum - Created 4 years ago - Last edited today

Recent Articles

Dear TradingViewers, here is my analysis on Bitcoin daily chart.Fundamentaly, the halving ha ...

What if instead of buying a stock, crypto, cur ...

Let's start on the weekly and daily charts:The weekly shows an ascending wedge.A rising wedge is oft ...

Hi guys, I've been thinking of how to make useful ideas, and here's what I came up with.I will be wa ...