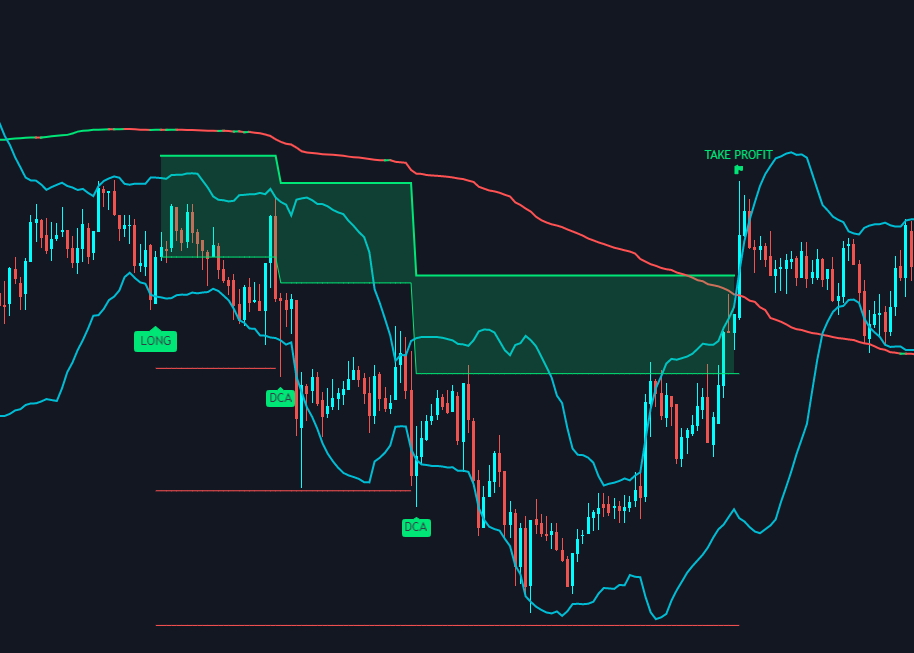

Safety Orders Explained and Risk Calculator

Do you want to know how it is possible to get an automated scalping strategy with a perfect stepping up equity line on other 100 trades like this one?

I believe risk management is key, because sometimes finding the perfect entry will not be enough.

The market is what it is, and nobody can predict with 100% accuracy how the price will behave, even with all the great indicators we got out there. With that in mind, we should come prepared that the price will go against you, and we should take advantage of it, because most of the time it will bounce back up.

This technique is especially useful in trading low timeframe also known as Scalping.

The idea is to lower the inital entry order size, and split the remaining order size progressively through the safety orders as the price goes against you. This will make the total trade average entry - or break even - at a lower place than if you were simply trading the initial entry. That means the take profit will also be lower, because we can now take profit from the total order size/volume.

What are the risks?

In the worst case scenario, which we know will happen at some point, the price does not go back up. It is important to know what are the risks so that we do no get liquidated or lose too much of our account.

This is why I made a risk calculator, so that you know what to expect when using the Safety orders on the indicators Cyatophilum Scalper, Cyatophilum Intraday Breakouts or Cyatophilum Ultimate.

Written by Cyatophilum - Created 3 years ago - Last edited today

Recent Articles

Game Theory Optimal (GTO) strategies are commonly used in competitive games like poker, where the objective is to make decisions that are unexploitable by opponents. Applying GTO principles to trading involves creating strategies that minimize losses and maximize gains, regardless of market conditions or the actions of other market participants.

Optimal Play

Just like in poker, trading ...

I'm thrilled to announce the release of my latest tool – the Bitcoin Trend Indicator (BTI), and it's available for free on TradingView!Based on CoinDesk's research, the BTI is designed to help you easily identify and analyze Bitcoin trends. With multiple exponential weighted moving averages analysis and clear trend signals, it's a powerful addition to your trading toolkit.Ready to give it a try? ...

Hi Traders, in this short tutorial we will see how to autotrade on Binance.

Requirements

- A TradingView account with Webhooks notifications.

TradingView allows you to backtest your strategy and create alerts. For now, our bot page only works with TradingView alerts Webhook notifications.

Important: the Essential TradingView plan is required to unlock this feature. Without Webhooks, ...

As of May 23, 2024, Bitcoin (BTC/USDT) is experiencing some notable movements on the daily chart. Here's an in-depth technical analysis to provide insights into the current market conditions and potential future price actions.

Price Action and Key Levels

Current Price: $69,265.99 (down by 1.26% today)

Resistance Levels:

...