Lastest news

Dear TradingViewers, here is my analysis on Bitcoin daily chart.Fundamentaly, the halving happened a few days ago, and as history shows the bull runs began way after the halving day. We could heard in French media that the price will be "halved". Maybe they were right !No, of course, the real definition is the block rewards being divided by 2, which is a bad news for miners which are seein ...

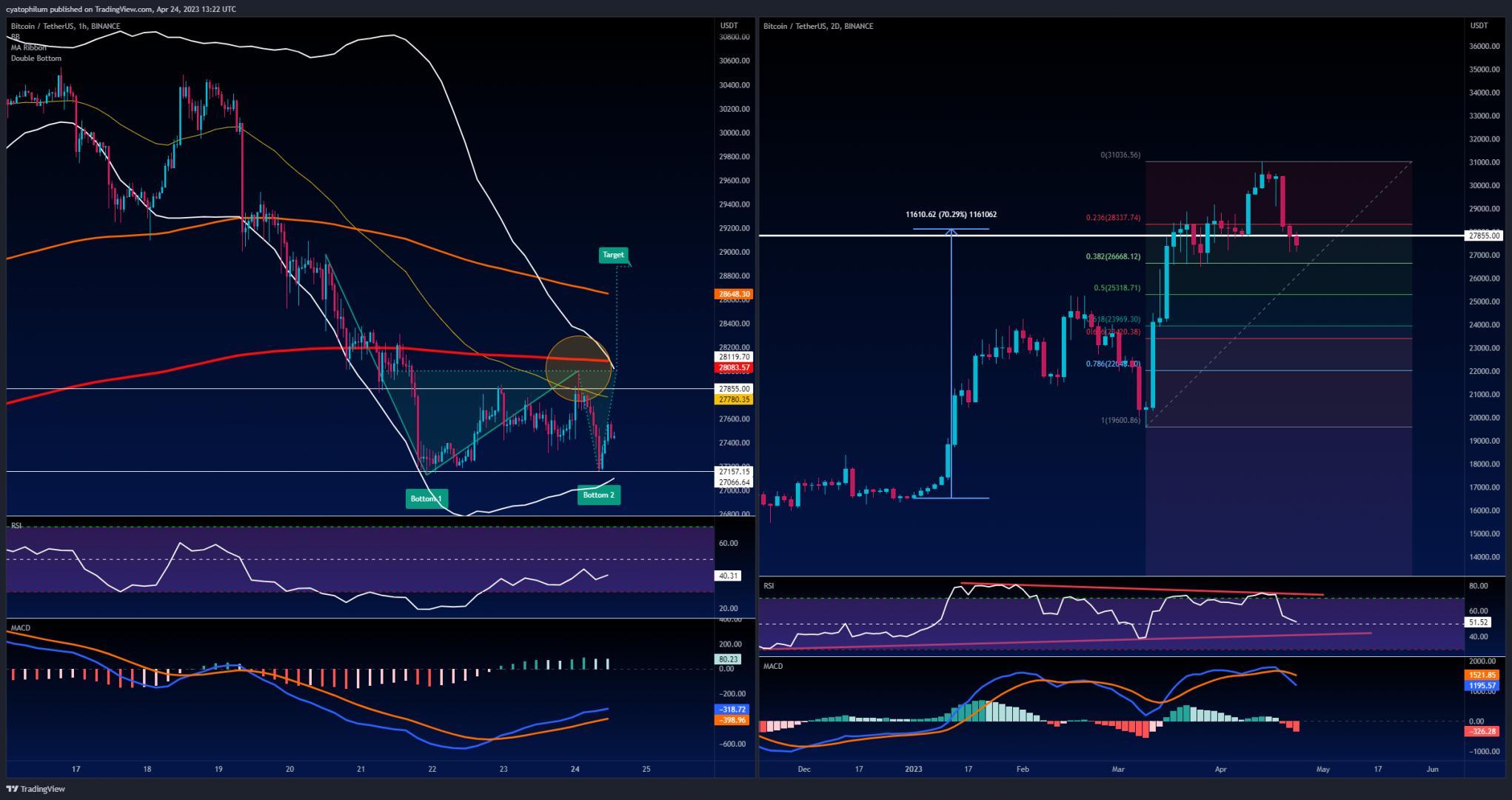

What if instead of buying a stock, crypto, currency only once and holding until we are in profit, we split our strategy capital and buy several times, until the total is in profit ? Yes, that is DCA you’d say. Ok, but what if instead of buying at predetermined intervals, we bought at oversold RSI, or on a double bottom, for example ? That’s ...

Let's start on the weekly and daily charts:The weekly shows an ascending wedge.A rising wedge is often considered a bearish chart pattern that indicates a potential breakout to the downside.Trading volume and RSI are also decreasing.=> The sentiment is bearish on the weekly timeframe.On the daily, we are seeing consolidation areas. The current area might be broken to either side, knowing the previ ...

Hi guys, I've been thinking of how to make useful ideas, and here's what I came up with.I will be watching useful coins in the top 100, starting with a high timeframe analysis and then continuing on the intraday regularly.Let's start with Bitcoin, the most popular digital currency, which offers to be your own bank, with a limited supply of 21 millions.On the weekly chart from above, we clearly are ...

How to Use the Volume Divergence Indicator to Improve Your Trading StrategyAre you looking for a way to improve your trading strategy? Look no further than the Volume Divergence Indicator, a powerful tool that can help you identify potential trading opportunities based on price and volume patterns.What is the Volume Divergence Indicator?The Volume Divergence Indicator is a PineScript c ...

In this article, we will analyze the current state of the cryptocurrency market through the lens of market cap, BTC dominance, and major indices. We will also look at the potential for an alt season, the impact of the upcoming Bitcoin halving, and which coins are outperforming BTC in the long term. Finally, we will provide a short-term perspective on the price of Bitcoin.

First, let's h ...